TDS Return Filing

In India, taxation is said as one of the biggest sources of income for the government. Income Tax Return is the form in which the assessee files information about his/her income and tax thereon to Income Tax Department. Along with the tax deposition, the assessee also needs to file for TDS Return. TDS Return Filing is a statement which shall be submitted by the deductor [assessee] on quarterly basis to the Income Tax Department.

A tax Return is the details of an entity’s or individual’s income earned in a time period. The amount of taxes which is being paid to the government organizations by the assessee and the same shall be recorded. In short it could be said as Tax Return is a document of assessee income and the amount which is being paid as tax on it.

The Income Tax Act, 1961, has made it mandatory for the citizens to file the returns for the financial year to the Income Tax Department of their state. These returns shall be filed on, as per their specified due date accordingly mentioned. It could be filed through the form depending on the criteria as of the source of income of the individual and the category of which he/she [assessee] belongs to.

What is TDS- Tax Deduction at Source?

TDS full form is Tax Deduction at Source. It refers to collection of tax on the income, rent, interest, dividends, salary, commission, professional fees, etc. The employer deduct an amount while payment of salary, commission, etc which is referred as the TDS.

For example, when an employer (deductor) makes a payment of salary to the employee (deductee) shall deduct the tax at source (an amount or rate which is prescribed to be deducted at the time of payment of salary) and transfer such amount to the Central Government.

This view has been adopted so as to collect the tax from the very source of income and the tax evasion could be controlled and barred by some means. Also the employee (deductee) would be liable to claim for the excess amount deducted at source from his salary while filing of the Income tax returns.

What does TDS Return Filing Mean?

As discussed earlier the employer needs to file the TDS Return also along with depositing the tax. The TDS Return Filing is a quarterly statement which shall be furnished to the Income Tax Department. The due date has been prescribed for filing the TDS Return and it shall be filled up accordingly. And it’s necessary to submit the same on time.

The TDS Return shall be filed via online mode completely. As the TDS Return Filing is submitted the details of the same will be mentioned on the Form 26 AS.

For Filing the TDS Returns below mentioned are some details to be furnished:

- PAN Card of the deductor and the deductee.

- The Tax amount that is paid to the government

- TDS challan information

- Others, if any.

Objectives of TDS

The following are the objectives for tax deduction at source:

- Firstly, as the salaried individual earns every month and to pay out the tax of such earning in that month only. This is very helpful for the salaried individuals as the tax is being deducted at the time of payment which doesn’t burden on the individual for a lump sum tax payment as monthly instalments are being paid.

- Secondly, the tax could be collected at the very time of paying the income to the assessee such as the professionals, salaried employees, contractors, etc.

- Government needs funds for the betterment of the public at large. Thus it requires funds to be raised in a continuing period. An advance tax and tax deduction at source would help the government financially throughout the year.

What is TAN?

TAN stands for the Tax Deduction and Collection Number. TAN denotes a ten digit number which contains alpha numeric code. This number is been issued by the Income Tax Department. An individual or any entity which requires deducting or collecting tax under the Income Tax Act shall apply for Tax Deduction and Collection Number to the Income Tax Department before the due date.

TAN is not required to be obtained by any salaried individual as their salary is being paid after deducting TDS. Although in the case of proprietorship businesses and other entity is different. As they need to make certain payments to their employees in the form of salary, commission, interest, etc thus it is required for them to obtain the Tax Deduction and Collection Number. Once the TAN has been issued to an entity, such entity shall file the TDS Returns quarterly.

Eligibility Criteria for Filing TDS Return

TDS Return Filing is accomplished by the entity or such employers who has availed a valid tax deduction and collection number (TAN). Any individual who makes payments to the employees (which is mentioned under the Income Tax Act) shall deduct the taxes at the source. The tax then needed to be deposited to the government in the specified time period.

Following are some of the payments for which the Tax shall be deducted at source:

- Payment of salary

- Income raised through securities

- Income which is raised through winning from lotteries, puzzles, and others.

- Income from winning horse races

- Insurance commissions

- Payment which is made for the National Saving Scheme and such others.

Benefits of TDS Return Filing

Tax Deducted at Source is dependable on the amount of what an individual earns. The Benefits of TDS Return Filing is enjoyed by both i.e. the government and the tax payers.

Following mentioned are some of the benefits of TDS Return Filing:

- Proper filing of TDS Return helps the government officials preventing tax evasions from the citizens. The Government officials maintains the record of the entity and individuals who pay out the tax and fine the one who delayed or missed out to file the TDS Return from the due date.

- Filing TDS returns provide government of India a steady source of revenue, as the TDS is filed every month by the deductors who come under the prescribed slab. This also helps the government to have a record of the individuals who file TDS regularly and track the assessee accordingly.

- The TDS Return Filing has broader the tax base for its collection towards the government. As the TDS is filed by the employer and a certificate is provided for the same to the employee whose TDS ID filed so there are less chances of tax evasion which results an increase in the number of tax payers.

- The Tax Collection authority needs to take into the account of every earning person, so that no person could be escaped from tax slabs and pay the tax accordingly on due time period. So the TDS return filing makes it easy for the tax agencies as well as for the deductor as the tax is deducted at the time of payment.

- The TDS return is filed by the Deductor on the income of the Deductee so the Deductee does not have to file tax again and the job of deductee as tax is deducted automatically.

Due Date for TDS Return Filing

The taxes are deducted on monthly basis of payment. The due date for filing the TDS Return is based on quarterly basis for the financial year. Below mentioned are the details of quarter, its period and the due date of its filing of a financial year.

Documents required for TDS Return Filing

The documents required for filing the TDS Return are divided in as general and specific:

General Documents

Following mentioned are some general documents:

- TDS Certificates of assessee.

- PAN Card information of the deductee.

- Bank account details associated with it

- Challans of payment of tax either self assessed or employer assessed.

- To response a notice from the IT department, the original return is required to be furnished.

- Transaction details for filing the TDS Returns

Specific Documents for Salary Income

Following mentioned are the specific documents required for salary payment individual:

- The Form 16

- The Salary Certificate

Specific Documents for Interest Statement

The specific documents required for Interest Statement is as follows:

- TDS Certificate of Bank

- Interest statement for FD

- Bank statement for interest on savings account for RD.

TDS Return Filing Procedure

The step by step procedure to file the TDS Returns Online is as follows-

Step 1:Firstly, the Form 27A has to be filled up. It contains various columns; all shall be filled out with the required details completely. For the hard copy of the form, it shall be verified with the E-TDS Return.

Step 2: Next, the TDS deducted and the amount which is being paid by the deductee shall be mentioned correctly and must be tallied before confirmation.

Step 3: Further, the TAN shall be mentioned of the organisation in the Form 27 A. Beware while adding the TAN, due to its wrongness the verification process may face difficulties.

Step 4: While filing the TDS Returns the challan number, the payment mode and the tax details must be mentioned. If the information filed doesn’t match, the TDS Returns needed to be re filled.

Step 5: Next, the BSR number shall be entered for the tally process.

Step 6: The TDS Returns shall be submitted offline at the TIN- Facilitation Centres. And in the case where the TDS Returns are filed online, it shall be submitted online via the website of the TIN NSDL.

Step 7: In case where the information filled is regarded as to be true to its nature, shall be provided with a token number or a provisional receipt. This will be regarded as a proof for filing the TDS.

Where the information filled is not found to be correct, in such a situation the TDS Returns get rejected. A non acceptance memo is issued in favour of such assessee mentioning the reasons of rejection in it. In case of rejection of application, the assessee needs to file the TDS again.

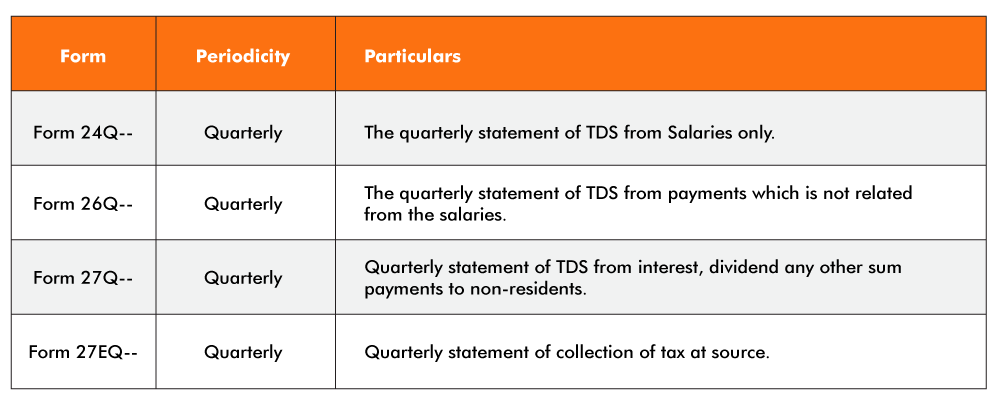

TDS Return Forms

The form for TDS Return Filing depends on the income of the individual or varies from the type of deductee. The TDS forms are mentioned below-

TDS Form 24 Q

In the Income Tax Act 1961, it is mentioned under Section 192, that an employer needs to deduct the TDS while paying the salary to the employee. Thus the TDS Form 24 Q, is filed by an employer for salary TDS which shall be submitted quarterly. The details of the salary and the TDS deducted from the salary paid to the employees shall be mentioned in the FORM 24 Q. Conclusively, it could be said as the Form 24 Q is the quarterly statement in which the employee’s salary and the Tax Deduction at Source is mentioned by the deductor.

TDS Form 26Q

The TDS Form 26 Q is filed when the source of income is raised other than salary. In the form, the details are mentioned of the payments i.e. the total amount that is being paid in a particular quarter and the amount which is deducted as TDS.

TDS Form 27Q

Form 27 Q is a TDS return or a statement that contains the details of the Tax Deducted at Source on payments other than salary made to a Non-resident India and foreigners. Form 27 Q is filed every quarter as prescribed accordingly on the due date.

Form 27 EQ

The Form 27 EQ is for the corporate and the government collectors. The deductors could also use this form. The form is required to be filed every quarter as mentioned in the Income Tax Act. The Form EQ covers the details about the tax that is collected at the source.

TDS Certificate

After the deduction of TDS of an individual or entity, the employer has to issue a certificate in favour of the same to the employee. The certificate can be then downloaded from TRACES (TDS Reconciliation Analysis and Correction Enabling System of the Income Tax Department). The employee can re-check the tax credit from it. The TDS Certificate is to be kept safe by the employee (deductee). If the certificate is misplaced by the deductee, it could be requested to get a duplicate of it from the employer. The TDS Certificate is classified into following two Forms:

In Case of Salary Income

- Form 16 is basically for the salary income which is issued annually by the employer.

- The deductor (employer) has to provide FORM 16 to the employee (deductee) in which the amount deducted from his salary shall be mentioned.

- Form 16 contains all the necessary particulars of salary related to its deduction, computation and payment of tax from salary.

In case of Non-Salaried Income

- Form 16 A has been provided for the Non salaried individuals.

- For the non salaried cases Form 16 A shall be provided to the deductee from deductor mentioning all the necessary information related to the payments of tax, its computation and deductions made.

- Form 16 A needs to be issued by the deductor to deductee within 15 days of due date of TDS Return Filing.

TCS Certificate

Tax Collected at Source (TCS) certificate that specifies the TDS amount collected and deposited with the Tax Department of India. Through Form 27 D the TCS Certificate is being issued.

Depositing TDS to Central Government

The TDS Employer or other authorities so appointed on for such task shall deposit the amount to the Central Government.

- The Deductor has to deposit the TDS amount to the Central Government via NSDL i.e. National Securities Depository Limited. This process could be used by a physical form which shall be submitted in certified ban braches accordingly.

- Through the official online portal of NSDL, the payment can be made by using the Challan 281 or through net banking.

- The E-payment procedure for all the assessee is must under the Section 44 AB.

Situations where TDS Shall not be Deducted

There are some situations where the TDS is not to be deducted while payment is made to the following mentioned entity-

- Where any interest is being paid to Unit Trust of India, Life Insurance Corporation and other cooperative or insurance societies;

- Banks;

- State or Central Financial Corporations;

- In cases where interest is being paid to Indira Vikas Party, Kisan Vikas Patra or National Saving Certificate;

- Situations where Interest is paid under direct tax or refund from the Income Tax Department;

- Where the Interest is received from savings accounts of cooperative societies;

- The interest credited to Banks or any banking company

- Interest which is credited to Non Resident External Account

- And all other entity which gets notified under the TDS.

Penalty for Failure in Filing the TDS Returns

There are two types of penalties which are given below-

Delay in Filing

If the assessee delays in filing the TDS Returns or files it after the due date, then the penalty of Rs. 200/- per day is being imposed on the employer until the time period the delay is to be continued.

Non Filing the TDS Returns

For the non filing of TDS Returns which is continued for a year by the deductor or if the deductor has furnished incorrect information in such cases penalty is being imposed to the deductor of not less than Rs. 10,000/- and which shall not be more than Rs. 1 Lakh.

Revised TDS Returns

A Revised TDS Returns is filled when any mistakes have been detected in the TDS Returns such as

- Incorrect challan information

- Missing of PAN details

- Incorrect PAN details, etc

In such situation the amount of tax credited to the government is not reflected in the Form 16 or Form 26AS. To solve such mistakes one needs to file Revised TDS Returns.

Prerequisites for Submission of Revised TDS Returns

The revised TDS Returns can be filed only when the previous TDS is duly accepted. It shall be accepted by the Tax Identification Number (TIN) Central system. The status of the TDS Revised Returns could be checked online on the website of TIN. The details to be entered for it are TAN number, provisional receipt number, token number, etc.

The Revised TDS statements are prepared by using the resent TDS or TCS statements. It shall be downloaded from the TRACES [TDS Reconciliation Analysis and Correction Enabling System] website.

Claiming TDS Return

If any assessee has filed the TDS Return, and any excess amount is being paid by him/her that could be claimed for refund. The time period for refund depends upon the assessee filing of ITR. If the ITR Returns were filed by the due time period, the refund of the excess amount shall be made by three to six months. On the other hand, if the ITR is not filed by the due time period, the assessee could be penalised for late filing or non filing of the ITR.

BizAdvisors Assistance for TDS Return Filing

The BizAdvisors has many professionals who will provide you the service for TDS Return Filing. We have experts who would assist in your queries related to TDS Return Filing from its compliances to its procedures and formalities involved in it.

The BizAdvisors will provide you such facility with a confirmation of its success not only for now but for future purpose also. All this facilities can be provided under one umbrella with many more other services that too with a least cost expenditure of yours.

The legal procedure has its various different process and formalities to be followed up. Such thing is not in the hand of a normal individual. Thus the requirement of experts arises here. Do contact BizAdvisors for queries related to TDS Return Filing and purchase our plan for letting it start.

Why BizAdvisors??

Following mentioned are some reasons one should choose BizAdvisors-

- We minimize legal requirements.

- Our clients can also keep track of the progress on our platform at any moment.

- Our knowledgeable professionals are here to answer any queries you have.

- We will make sure that your interactions with professionals are pleasant and smooth.

- We always try our best to make our clients happy with the legal services we provide.

- We provide free legal advice.

- Our prices are transparent and reasonable.

- We deliver your work on time.

- We have a team of experts.

- We give a money back guarantees as well.

- We give an option of easy and convenient EMIs.

All company or entity which makes the payment to their employee shall deduct tax at source. Although a tax slab is being prescribed by the government, exceeding such amount would be liable to pay Tax at Source. TDS Return Filing is important for all the taxpayers. The benefits arising from it is availed by both the government as well the tax payers.

The procedure involves with the TDS Return Filing is complex with the documentation. Thus it shall be filed with the help of professionals. We the BizAdvisors provide such facility for our clients. The professionals at BizAdvisors are well versed with the process and requirements relating to TDS Return Filing. For the clients queries we originate new ideas and try to accomplish the task with minimum requirement of monetary charges. Do contact BizAdvisors for any query related to the Legal Services. We are here to provide you with the best and to the best.

Frequently Asked Questions

An individuals who earns a certain amount annually is mandate by the government for filing the tax return in a specified manner and by due date. Also the different tax slabs are created by the government for easy filing of tax return. The tax shall be payable to the government either by the assessee them self or by the deductor. Failing to file the returns would impose the penalty on the assessee.

The return filing helps the businesses to enter for subsequent transactions as they could avail it as a proof for future to the Income Tax Department. Also it is mandatory from the side of the Central Government.

The different types of Income Tax Return Filing are as:

- Normal Return

- Belated Return

- Due Date for filing Belated Return

- Revised Return of Belated Return

- Revised Return

- Loss Return

- Defective Return.

Generally there are two types of TDS Certificate and are mentioned below:

- FORM 16: it is for the salaried individuals. The form is issued by the employers mentioning the details of the tax deduction at source to the employee.

- FORM 16A: it is for the non salaried individuals.

9559179325

9559179325 9559179325

9559179325 9559179325

9559179325