Overview of IEC Registration

IEC is commonly referred to as the Import Export Code. With a growth in transportation and communication technology, the Indian business is also expanding its way through it. To expand the business moreover to other countries helps in exposure to the business as well as the country itself. For such exposure an individual or business entity requires to obtain an IEC Registration.

It denotes a code number for the individual or business entity who is engaged in import or export activities or both. The code is mandatory for all entities who are engaged in such work business in India. The IEC Registration provides various benefits to business which helps to boost the growth level of the company.

Thus IEC plays a major role for the business established in India. It stands out as an essential requirement to run the business for import and export at a global market level. This helps the Indian market to evolve over the other countries as well.

What is IEC?

As denoted earlier, IEC stands for Import and Export Code. It is required to be obtained by every businessman whose major transactions move for import and export activities through India. It has a ten digit code number which represents the business entity. The code is issued by the Directorate General of Foreign Trade (DGFT), Government of India to the business entity.

The IEC has its validity for lifetime once obtained till the business is in existence. Thus the need for its renewal is not required by its holder. And the business would perform all such activities smoothly.

Due to which, IEC shall be obtained as soon as possible because in its absence such a business entity would make it difficult for the business to be efficiently working in such a field.

What is IEC Registration?

An IEC Registration is regarded as a legal document for the import, export business perspective. It is mandatory for the business to register themselves for the registration to avail the benefits through it. An IEC Registration is not required for individual or legislative purpose for any goods or services imported or exported in India.

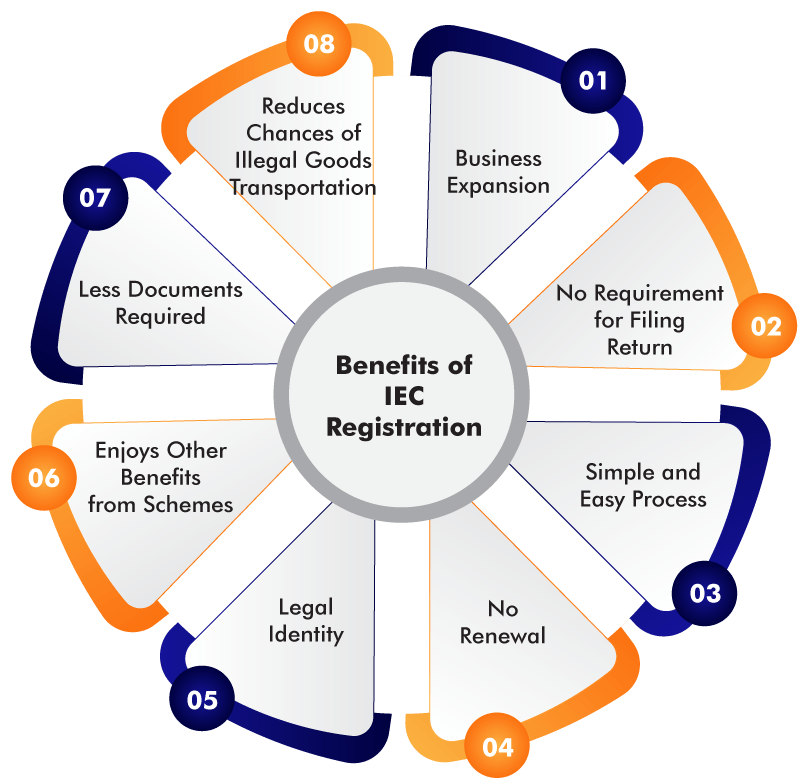

Benefits of IEC Registration

Registration of IEC involves various benefits for the business entity or any other person engaged in such businesses which are mentioned as follows:

- Business Expansion

- No Requirement for Filing Return

- Simple and Easy Process

- No Renewal

- Legal Identity

- Enjoys Other Benefits from Schemes

- Less Documents Required

- Reduces Chances of Illegal Goods Transportation

Through IEC Registration, one gets a chance to expand their business in the global market. That will further create a name and fame for the business goods and services as well as the individual's image will be maintained in the international market for such goods and services provided by them. Thus it increases a scope for business development in the international market level.

Another benefit of IEC Registration is that there is no requirement to file any returns for IEC Registration. Once the IEC is obtained, there is no other formality to prove its legitimacy. Thus with less compliance it’s easy to apply for it. And can benefit from IEC.

The process for IEC Registration is easy. Due to non requirement of evidence relating to import or export helps to file for registration easily. Further, the IEC could be obtained in less time i.e. a time period of 10 to 15 days is probably required after submitting the application with required documents. Thus, the IEC Registration is regarded as a simple and easy process.

For IEC Registration, there is no renewal requirement by the businessman. Thus it could be said as free for lifetime once obtained till the business is in existence. This gives a plus point for registration. Once registered and enjoyed for a lifetime.

By IEC Registration, once a business gets legal identity as it is certified through the government itself. It could also be said as government identity. It is helpful for any hindrances during the process of shipment. And work as proof for the custom authorities. Thus gives a great advantage.

By IEC Registration, the holder also enjoys various other benefits apart from this. There are various other schemes which can also be availed by the holder. The schemes are provided by the Export Promotion Council, the Director General of Foreign Trade, and Customs.

For obtaining IEC Registration, the documents requirement is very less. Only a few normal documents are to be asked to submit like PAN Card of the applicant, Address proof of the applicant, Passport size photographs of the applicant, etc. This requirement makes it simpler.

To obtain import export code, the basic need is to provide authentic information regarding goods and services. Thus without it the IEC cannot be obtained. Due to which transportation of illegal goods through India will be decreased or makes it impossible.

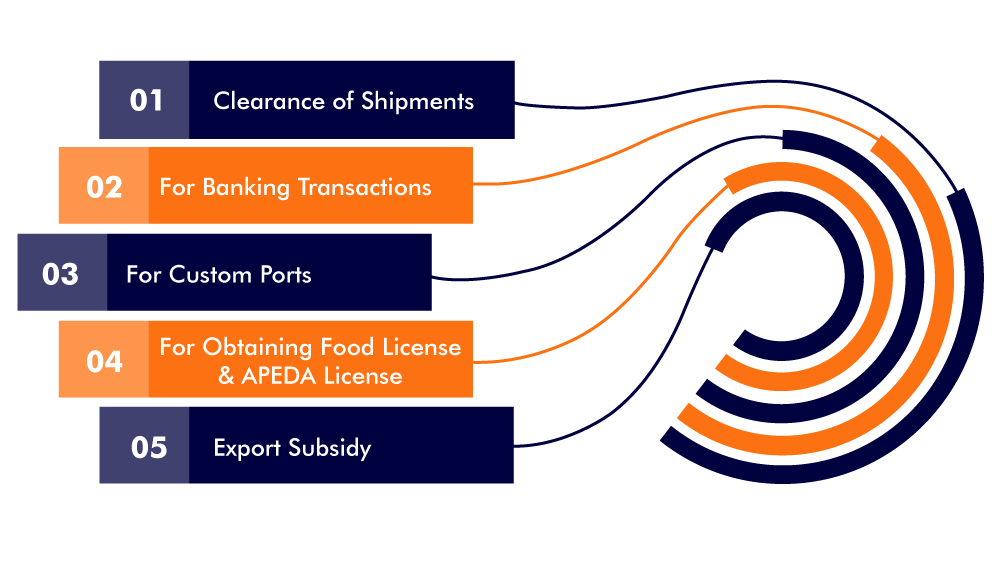

When is IEC Registration Mandatory?

IEC Registration is mandatory in the following mentioned situations-

- Clearance of Shipments

- For Banking Transactions

- For Custom Ports

- For Obtaining Food License and APEDA License

- Export Subsidy

While clearing the shipments an importer is required to share the IEC code to the custom authorities.

When the importer sends money to other countries through a bank, in such cases IEC code needs to be disclosed to banks. And when an exporter receives money in his bank account in the form of foreign currency, in such a situation the exporter needs to inform the bank.

An exporter exports his shipments abroad, in such cases the custom ports ask for IE Code.

To obtain Food license and Agriculture and Processed food Products Export Development Authority (APEDA) license, IE Code is mandatory to be obtained.

When an exporter wants to avail export subsidy, then the IE code shall be disclosed to the export promotion council.

Exemptions from IEC Registration

Following mentioned is the situation where IEC Registration is not compulsory to be issued:

- All traders who are registered under GST did not require applying for IEC Registration. In such cases the Pan card of traders could be treated as a new import export code.

- When goods or services, imported or exported, are done for personal purposes and not for commercial use, such persons are not required to obtain IEC Registration.

- While the Central or State Government of India, Registered Charitable institutions engaged in Import and export business are not required to obtain IEC Registration.

- Individuals who import or export goods or products from or to Nepal, Myanmar via Indo- Myanmar areas are exempted from IEC Registration.

Who Requires IEC Registration?

The DGFT has made it obligatory for the following entities to obtain IEC Registration-

- Every Export House is eligible for IEC Registration.

- Such productions that import raw materials are also allowed to apply for IEC Registration.

- Such entities that are going to be involved in Import Export Business.

- All Importers and Exporters.

- Any manufacturer who is involved in exporting also requires obtaining IE Code.

- Any importer who seeks special authorisation from the Directorate General of Foreign Trade for any particular goods or products is also eligible for IEC Registration.

Documents Required for IEC Registration

To register IE Code in India following are the required documents for it-

- PAN Card of the business,

- PAN Card of the applicant,

- Aadhar card, Voter ID Card, Driving License, Passport of the applicant,

- Passport size photographs of the applicant,

- Certificate of Incorporation of business,

- Address proof of applicant such as electricity bill, sale deed or rent agreement of office,

- Bank details of the current account which is on the name of company,

- Cancelled Cheque details,

- A self addressed envelope for IEC Certificate delivery through registered post.

Procedure to Obtain IE Code Registration

IEC is only allotted to such entities which are registered in India. Thus before applying for IEC, the entity shall ensure for obtaining Business Certificate first.

The procedure to obtain IEC Registration is mentioned as follows:

Step 1: The applicant needs to obtain a Digital Signature from a certified agency. And then I need to visit the site of DGFT for filing an application.

Step 2:In the page, a service tab is provided at the top menu of the page. By clicking on it, it will show further options and then click on IEC Tab and further for Online IEC Application.

Service Tab 🡪 IEC Tab 🡪 Online IEC Application.

After selecting the online IEC application, another page will be displayed.

Step 3: The new page which is displayed will require PAN Card details to be entered. In case of an individual, his Pan Card details and in case of a firm or any other entity, the Pan Card details of the firm are required to be inserted.

Then click on the Search button.

Step 4:Next, enter the details as required. It shows the name, date of birth/ Incorporation and a Captcha code. All details shall be filed as prescribed in Pan Card.

Then click on the Submit button.

Step 5: Later, enter mobile number, email ID, Captcha code.

Click on the Generate OTP button.

And then you will receive an OTP number on the prescribed mobile number and on email.

The OTP received in mobile and email shall be inserted accordingly on the respective tab.

Step 6:Then fill and update the application “Entity Details” - applicant details and applicant entity details.

Step 7:After filing and updating the application, click on the second alternative i.e. IEC “Branch Details” at the top of the page.

Add all the required branch details in it of the company or firm. And press the ADD button mentioned at the bottom. If there is no other branch office, you have the option to keep the space empty.

Step 8:Click on the next tab from the above mentioned tabs i.e. “Director/ Partner Details”. In the page displayed, insert all the required details of Director/ Proprietor/ Partner. The details shall be of PAN card number, mobile number, address proof, etc.

Step 9: After filing of the details, click on the alternate tab option i.e. upload documents.

In this tab all the required documents properly scanned shall be attested. Address proof, Bank certificate, Cancelled cheque, etc shall be uploaded. The option is also available to upload documents of quality type.

Step 10:The next step is to pay the prescribed fee. Click on the “Fee Payment” tab. And pay the amount of Rs. 500/- as government fee for IEC application.

Later, the payment shall be made via any mode i.e. Debit/ Credit Card, Net Banking, Wallets, etc. Then the payment made can be verified accordingly by the applicant by clicking on “Verify Pay”.

Step 11: Now, all the steps are completed, the application form can be preview now and can be printed out. In the preview section the applicant shall check all the details filed and make necessary corrections accordingly as required in it.

Step 12: The application is now ready to be submitted. In the details it will auto- populate the DGFT Office. Then click on proceed further. After this, a new page will be displayed in which “Submit and generate IEC Certificate” will be shown. Click on the button. By this the process ends for the applicant.

Inspection: When the application is submitted with required information, a thorough legal check is made by the concerned Inspection authority as per the guidelines. After the inspection is completed of all the required documents, and the application seems to be proper, the IEC Registration Certificate will be issued for the applicant by the concerned Regional Officer.

If any default arises in the application, the same shall be mentioned to the applicant accordingly. In such a situation the applicant needs to file the application again.

Certificate of Origin

The Certificate of Origin is commonly abbreviated as CoO or CO. It is required by the international businessman who holds an IEC License. It is regarded as an important document for international business. The Certificate of Origin clarifies the product of a certain country. It denotes that the goods are obtained, produced, manufactured from that certain country only.

An exporter requires filing for the Certificate of Origin as that declares nationality of the product. And even the custom port, banks, etc requires a certificate of origin. The COO is applicable in almost all the countries engaged in export business.

A certificate of origin could be obtained by the Indian chamber of commerce and Trade Promotion Council of India. Both of the mentioned government entity issues COO to the applicant in India.

IEC Registration can be cancelled?

IEC Registration can be cancelled if the following situations arise:

- The rules and regulations of Foreign Trade Policy are infringed.

- Import or Export of such goods which are under Prohibitive List.

- Misleading the custom authority over any shipment details.

- The registration acquired for particular goods to be imported/ exported but not done so via shipment.

- Violation of Customs rules.

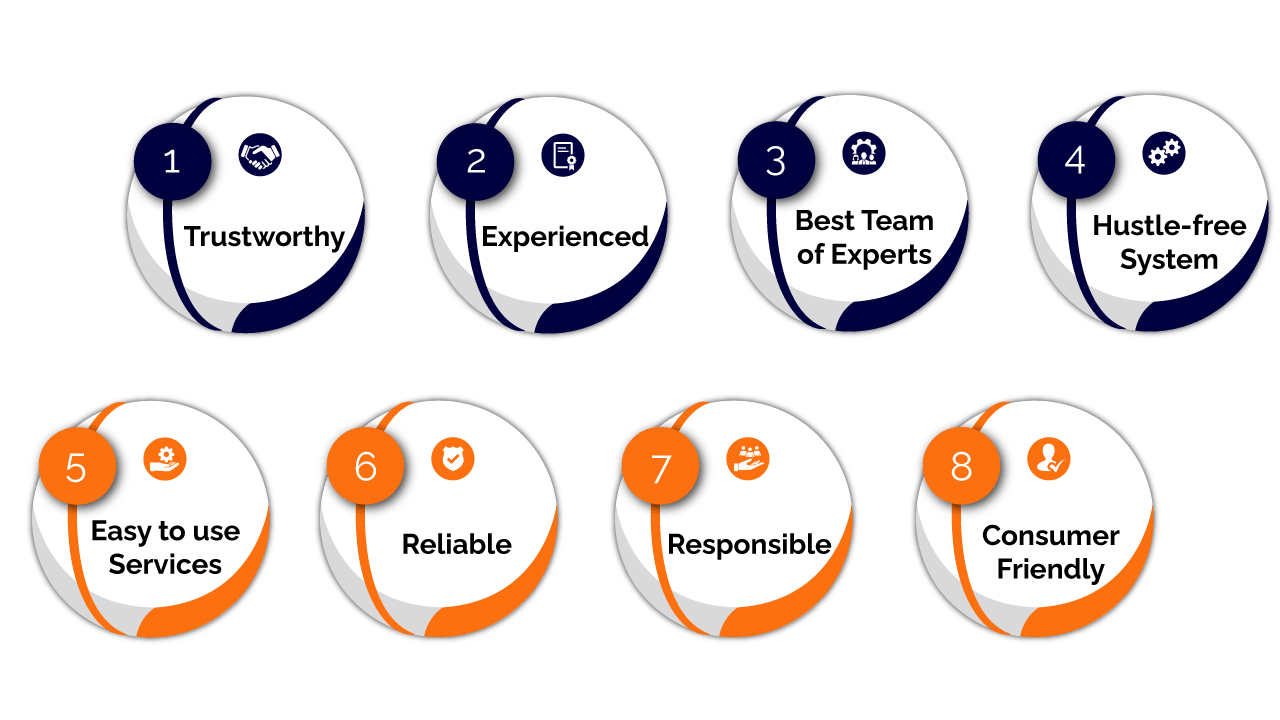

BizAdvisors Assistance for IEC Registration

BizAdvisors is one of the leading cloud based technology companies which provide legal services and many more services. We provide IEC Registration with a minimum time period and costing. The services we provide for IEC Registration is as follows:

- We provide our best Professionals to guide you for IEC Registration.

- You just need to book an appointment with us and our experts will help you out with your query related to IEC Registration.

- You need to submit the required documents and information for IEC Registration and our professional will prepare the application in prescribed format.

- Applicant’s digital signature will be attached via filing application in DGFT.

- We have advanced technology through which we can provide you registration in a minimum time period.

Why BizAdvisors?

The Bizadvisors have great facility for the client’s business upbringing and following are some reasons one should choose Bizadvisors:

- We minimize legal requirements.

- Our clients can also keep track of the progress on our platform at any moment.

- Our knowledgeable professionals are here to answer any queries you have.

- We will make sure that your interactions with professionals are pleasant and smooth.

- We always try our best to make our clients happy with the legal services we provide.

- We provide free legal advice.

- Our prices are transparent and reasonable.

- We deliver your work on time.

- We have a team of experts.

- We give money back guarantees as well.

- 200+ CA and CS assisted us in our work.

- We give an option of easy and convenient EMIs.

IEC Registration is mandatory for all the business entities who are engaged in import and export activities of goods or products in or out of India. The IEC Code is a pass for the entry or exit of goods through India. By registration it provides various benefits to the applicant. And by being a mandatory document it requires to be registered by all such business entities.

On the other hand, applying for it is also a complex task and time consuming. Thus the requirement of professionals arises here. The expert of IEC Registration will help you through the process of IEC complete registration process. A proper guidance for the procedure and documentation would be discussed and informed accordingly. The Bizadvisors have such experts who have great knowledge regarding the IEC Registration and its compliances.

So do contact Bizadvisors for any query related to legal services. We are here to help you out with the best team of professionals and experts and deliver the result in a minimum time period.

Frequently Asked Questions for IEC Registration

IEC is Import and Export Code. The code is obtained by the business entity to expand their business further into the global market. It is issued by the DGFT to the entity applied. The code is regarded as a mandatory legal document obtained by the individual or any business entity engaged in such activities in India.

The documents required for registration of IEC are as follows:

- Aadhar card/ Voter Id Card of businessman or individual as identity proof,

- PAN Card of company or individual,

- Cancelled cheque from the bank,

- Proof of company or firm’s office address, for which the office’s rent agreement or electricity bill is required.

- Business expansion into the global market.

- No renewal is required.

- It is obtained for lifetime once obtained.

- Avail subsidies

- Easily port clearness

- It gets a legal identity

- Can also enjoy benefits from various schemes provided by DGFT, EPC or other such authorities engaged in.

9559179325

9559179325 9559179325

9559179325 9559179325

9559179325