Brief of NBFC Registration

The term NBFC (Non-Banking Financial Company) refers to a company that engages in financial activities such as secured and unsecured loans, investments, Marketplace lending, financial information services, or any other business objectives as defined by section 45-IA of the RBI Act of 1934 and the Companies Act of 2013. Although an NBFC engages in a variety of finance activities, it does not hold a complete banking licence. A company that wants to start a lending or investment business must first get a Certificate of Registration (COR) from the RBI. The RBI has simplified the NBFC Regulation, making the process of obtaining a licence easier than before.

Personal Loans, Business Loans, Auto Loans, Gold Loans, Assets Financing, Acquisition of Shares, Stocks, Bonds, Hire-Purchase, Insurance, Currency Exchange, Peer to Peer lending, Hedge Funds, and other NBFC services include but are not limited to: Personal Loans, Business Loans, Auto Loans, Gold Loans, Assets Financing, Acquisition of Shares, Stocks, Bonds, Hire-Purchase, Insurance

For efficient administration and seamless operation of NBFCs, RBI has formed two separate divisions. Department of Non-Banking Regulation and Department of Non-Banking Supervision are two departments that regulate and supervise non-banking institutions. CGM is in charge of both of these departments (Chief General Manager Level Executive of the RBI).

NBFC's Role and Function in India

The RBI has identified the NBFC's distinct duties as follows:

- Infrastructure development is one example.

- Assist in the creation of riches.

- There will be a significant increase in the number of people employed.

- To provide financial assistance to those who are economically disadvantaged.

- Aids in the development of the economy.

- A significant contribution to the state coffers.

- Long-term audit and specialised financing are provided by NBFCs.

- Aids in the growth of financial markets.

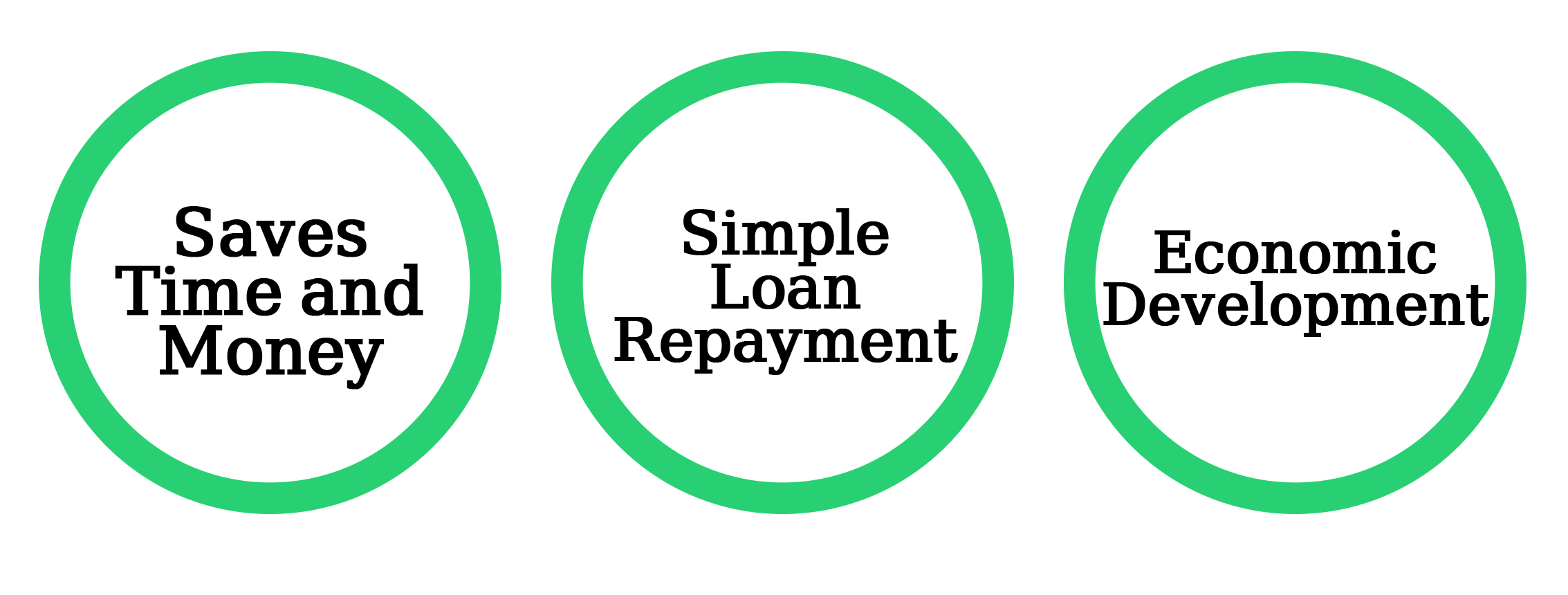

Advantages of NBFC Registration in India

In India, the advantages of an NBFC Registration are as follows:

Time and money are saved.

In comparison to small banks, forming an NBFC is a simpler process. Opening a bank requires a significant amount of capital, effort, and expense, but an NBFC does not. To obtain NBFC Registration in India, all that is required is the assistance of a good NBFC consultant with prior expertise.

Loan repayment is simple.

NBFCs function in a systematic manner and provide individualised lending products with manageable repayments. Borrowers will find it to be a convenient method because they will be able to repay the loan amount fast and within the specified time frame.

Payment & Settlements System Regulations, 2008

The same addresses all issues, including the application for authorisation to begin a payment system, the issuance of such authorization, payment instructions, payment standards to be maintained in the payment system, timely filing of required papers and financial information, and so on.

Economic Development

For their financial needs, businesses and individuals seek an easy and dependable source of credit. For personal and business-related credit needs, NBFCs provide inexpensive and secure loan facilities to an underserved market. As a result, by providing financial independence to MSMEs, self-employed professionals, and people, NBFCs have contributed to the country's economic progress.

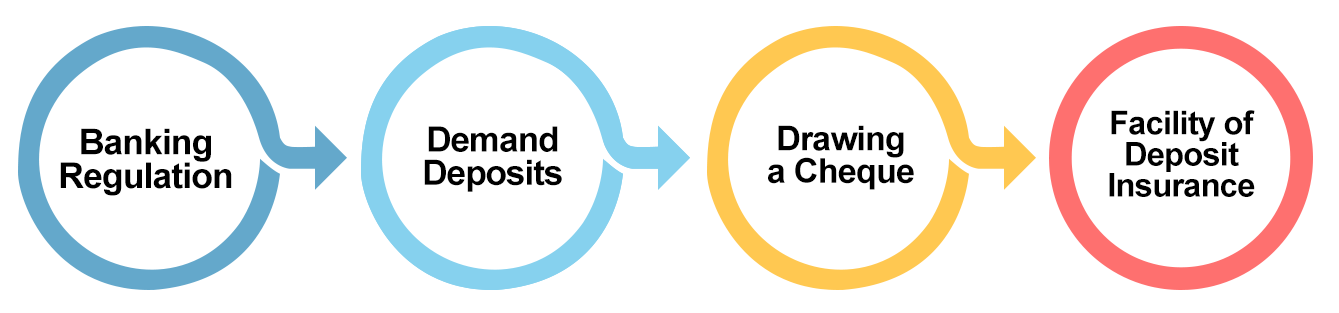

What distinguishes an NBFC from a bank?

Although both NBFCs and banks engage in financial activity, there are some distinctions between the two:

Act of Regulation

NBFCs are controlled by the Indian Companies Act of 2013, whereas banks are overseen by the Banking Regulation Act of 1949.

Demand Deposits

NBFCs are unable to accept deposits from their consumers, although banks do.

Drawing a Cheque

NBFCs are unable to issue or draw cheques on their own, whereas banks are able to do so freely.

Deposit Insurance Facility

NBFC depositors do not have access to the deposit insurance facility, whereas bankers do.

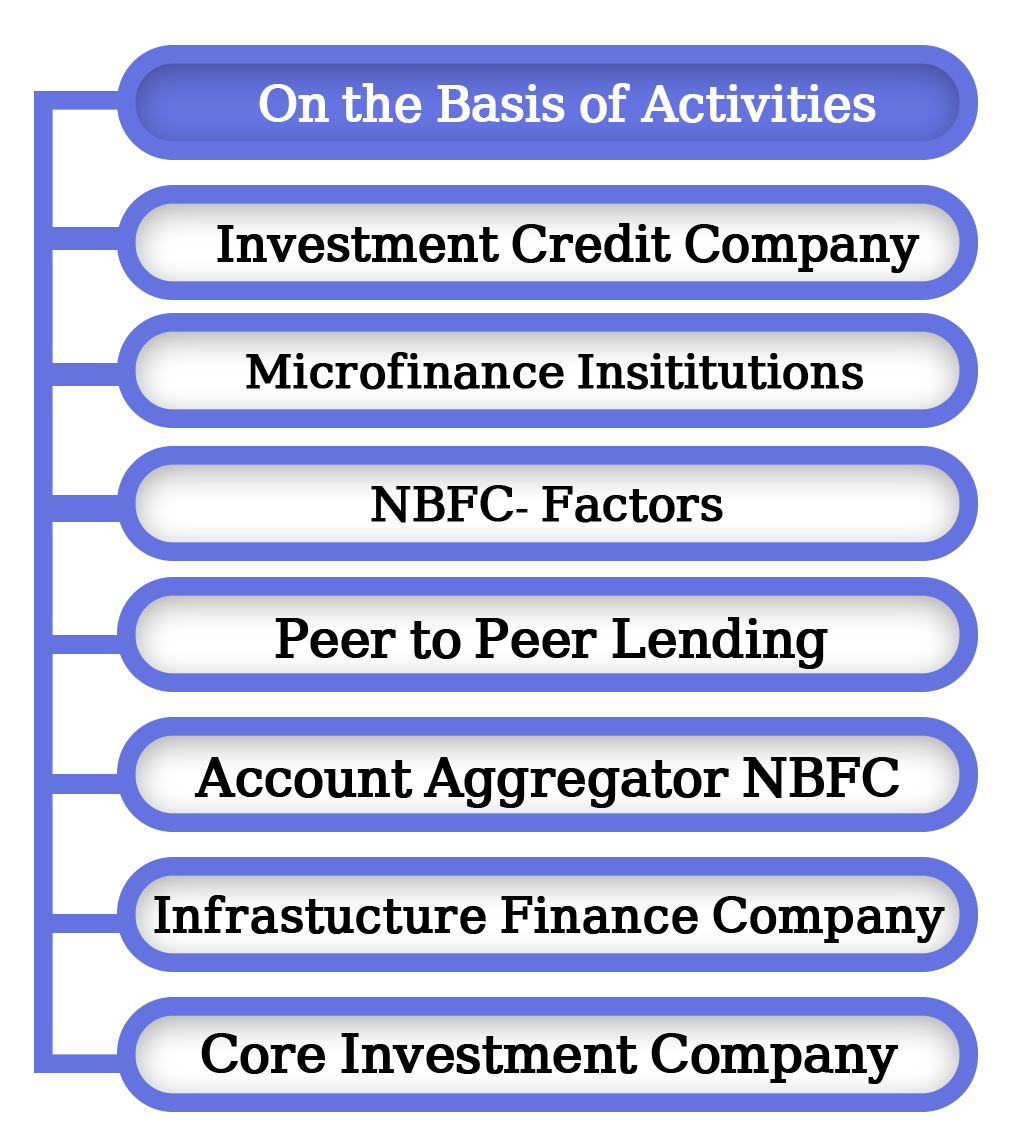

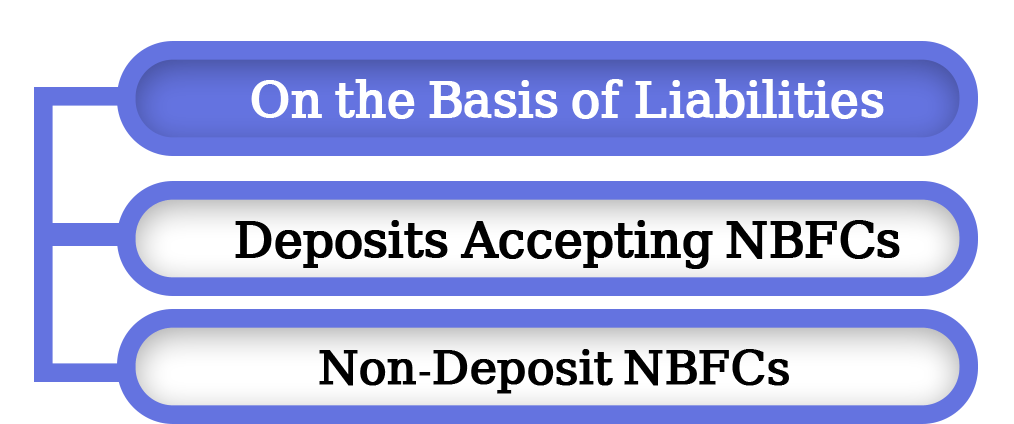

Types of NBFC

NBFCs are classified into the following types:

Investment Credit Company (ICC)

In India, the ICC is a single licence that covers all sorts of finance. There were three separate licences available before to February 2019, namely Loan Company, Asset Finance Company, and Investment Company. After merging into a single licence known as ICC, the licence holder can now engage in a variety of wholesale retail loans and investment activities. The NBFC ICC License is expected to take 120 days.

Microfinance Institutions (MFIs)

The NBFC-MFIs provide loans to households with yearly incomes of less than $120,000 in rural areas and less than $160,000 in urban and semi-urban areas. Around 85 percent of MFIs' financial assets must be in the form of the above-mentioned qualified assets. MFIs' minimum net owned funds must be less than INR 5 crores. The NBFC CIC License could take up to 200 days to obtain.

NBFC-Factors

Factoring is the primary business, accounting for at least 50% of total assets, and factoring income should not be less than 50% of gross income.

Peer to Peer Lending (NBFC) (P2P)

P2P lending intermediaries provide an online platform that includes highly secure credit and risk assessment fintech driven platforms that run automatic risk assessment checks of the applicant and determine credit risk of the borrowers, and Artificial intelligence-based platforms that automatically publish the loan requirement along with the borrowers’ profile and risk rating on the platform. Borrowers can obtain loans from others ready to lend their money for an agreed-upon interest rate through the peer-to-peer lending industry. The RBI's in-Principal Approval for a P2P Lending License could take up to 180 working days. Following In-Principal Approval, the Applicant must complete the Mandatory CISA Audit.

Account Aggregators for NBFCs

This is the newest NBFC category. NBFC Account Aggregators facilitate data sharing between numerous financial sector organisations and serve as "consent brokers," i.e., they facilitate data transmission between financial institutions with the user's approval. Account Aggregators' activities include the collection of financial data from a variety of accounts, including bank accounts, investment accounts, company accounts, consumer accounts, and other related financial accounts, on a single platform. NBFC-AA also has a Net-Owned Fund requirement of INR 2 crores.

Infrastructure Finance Company (IFC)

An infrastructure finance company invests at least 75% of its total assets in infrastructure loans. It must also maintain a minimum Net Owned Funds of $300 million and pursue a minimum credit rating of "A" or comparable with a CRAR of 15%. The NBFC IFC License could take up to 240 days to obtain.

Core Investments Companies (CIC)

These NBFCs are involved in the acquisition of shares and securities and must meet the following criteria:

- Holding 90% of its total assets in the form of equity, preference shares, debt, or loans in group firms;

- Not engaging in any other financial activity other than those stated in paragraph (a);

- The NBFC CIC License could take up to 180 days to obtain.

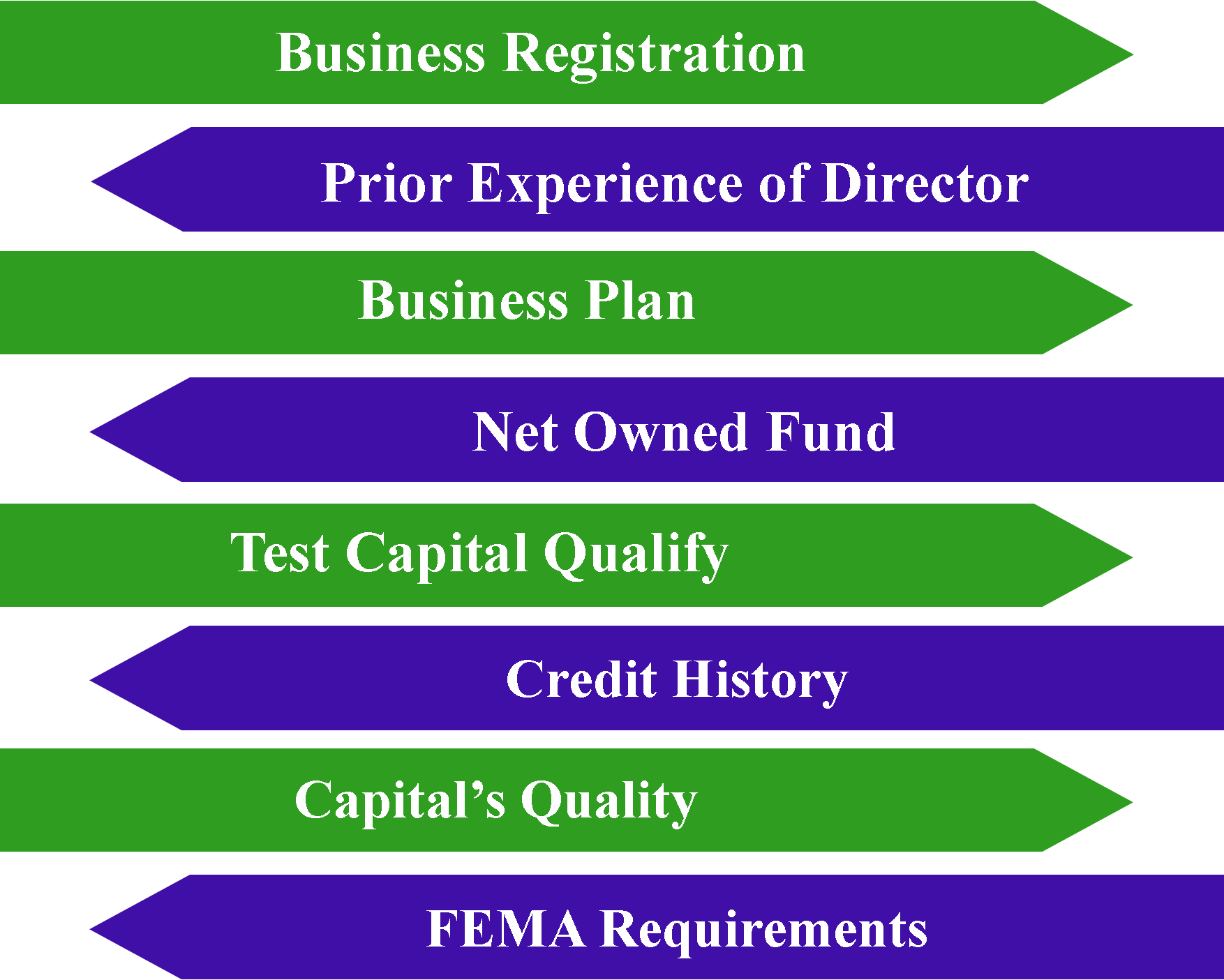

NBFC Registration Pre-Requisites

According to Section 45-IA of the RBI Act, 1934, the following conditions must be met in order for an NBFC to be registered:

Registration of a Business

A company must be registered under the Companies Act of 1956 or the Companies Act of 2013.

Director's Experience

1/3rd Director's Experience In order to apply for an NBFC licence, the directors of the applicant company must have prior financial experience.

Five-Year Business Plan .

An applicant company must create a detailed five-year business plan.

Requirement for a Minimum NOF (Net Owned Fund)

The applicant company must have a minimum NOF of Rs. 2 crore and the tax on it must be paid. The entry point norms are to be changed from 2 crore to 20 crore based on increases in prices, real GDP, and regulatory judgement. New registrations are effective immediately; however, existing registrations may be extended for a period of time, such as five years.

Test Capital Qualify

The RBI conducts a quality of capital examination to ensure that invested capital is not in violation of the law.

History of Credit

The company's, directors', and shareholders' credit scores must be good, and they must not have intentionally defaulted on loan repayments to banks or NBFCs

Capital's Quality

The mandatory compliances must have been met by the application company.

FEMA Requirements

An applicant company must have conformed with the FEMA Act if foreign investment is involved. FATF member nations are authorised to bring in 100% of their FDI.

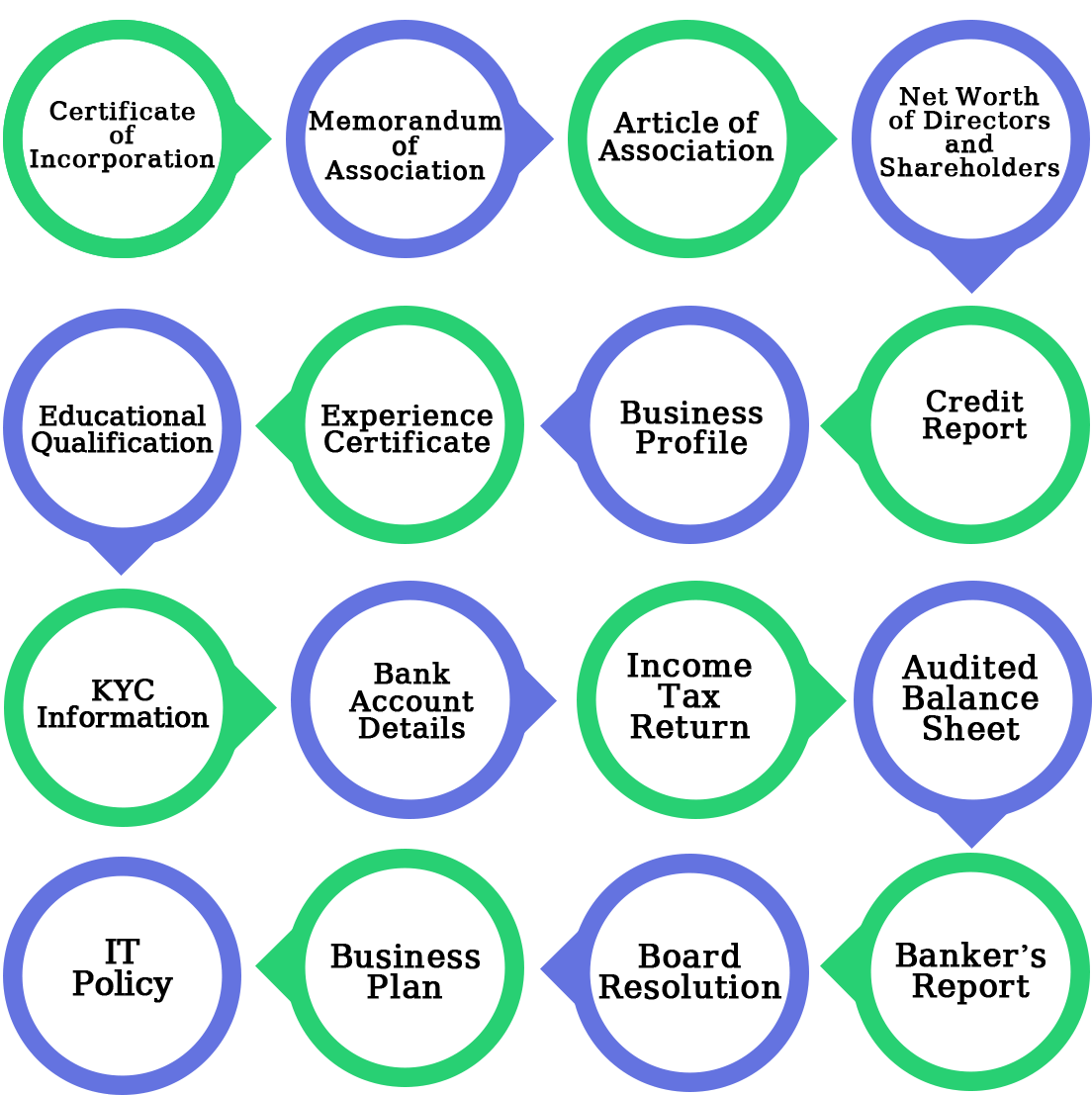

Documents Required for NBFC Registration

Following are the required documents-

- COI (Certificate of Incorporation) / MOA / AOA certified copy;

- Certificate of Directors', Shareholders' Net Worth;

- Company's Net Worth;

- Certificates of Extensive Experience;

- Directors' and shareholders' credit reports;

- KYC information, the company's PAN, GST number, and address proof;

- Details of the company's bank account [Rs. 2 Cr must have been deposited as NOF];

- . Related Party Disclosures;

- Income Tax Returns;

- Audited balance sheet for the last three years or from the date of incorporation;

- A banker's report confirms that there is no lien on the fixed deposit.

- The format of the board's resolution for NBFC registration.

- Underwriting model - Detailed 5-year action plan, including a Fair Practice Code and a risk assessment policy.

- The structure of a business and the structure of a loan are both important.

- Information Technology Policy.

What is the procedure for registering an NBFC?

To start your NBFC, follow the steps outlined below:

- Hire a seasoned NBFC registration consultant with at least ten years of experience and a team of seasoned professionals including CAs, CSs, lawyers, and senior bankers.

- Finance, FinServ, Final, Investment, Capital, Fintech, and Leasing must all be included in the proposed firm name.

- Create a private limited company or a public corporation.

- Make a list of your registered office, city, and operational area.

- Obtain an Incorporation Certificate from the Registrar of Companies.

- Deposit net owned funds into the company's bank account.

- . Documents required to obtain an NBFC licence.

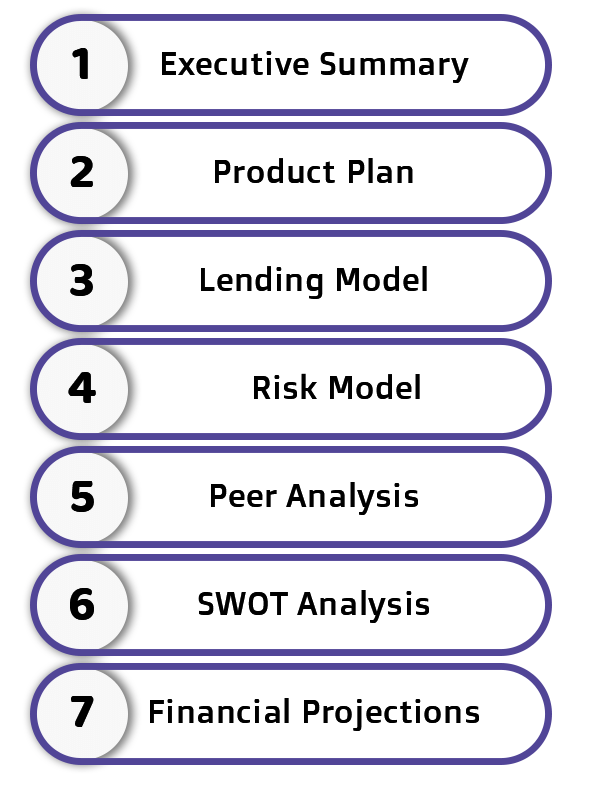

- Drafting of Business Plan for the next 5 years consisting:

- Apply for RBI registration under the RBI Act of 1934.

- On the RBI's official website, the applicant company must submit an online application.

- After that, an application will be given a reference number (CARN) to help with future inquiries.

- After that, the duplicate hard copies must be submitted to the RBI's concerned regional office.

- All documents submitted to the regional office must be checked for accuracy.

- The regional office will forward the NBFC registration application to the central office.

- The NBFC must start doing business within six months of receiving its Certificate of Registration.

RBI Requirements for Obtaining an NBFC License

After filing an application for NBFC registration, RBI will review the file and issue a licence only if the following conditions are met:

- The ability of an NBFC to repay its debts to investors, as well as the company's business plan, must serve the greater good of society.

- NBFC operations must not be damaging to the general public's interest.

- Sufficient Capital Infusion Capability

- The Proposed Business's Earning Capability

- Activities must be carried out in a way that is beneficial to the general population.

- The Board must act in the public's or depositors' best interests.

- The granting of a licence will contribute to the country's economic prosperity.

- The proposed NBFC must adhere to RBI requirements.

Penalty Provisions — In the event of non-compliance with RBI Regulations.

Penal Provisions in Case of Non-Compliance with RBI Regulations are as follows:

Carrying on NBFC Business Without A Certificate Of Registration From The RBI

1 to 5 years in prison and a fine of Rs. 1 to 5 lakhs

Non-compliance with RBI guidelines.

Up to three years in prison

Failure to provide documentation or to respond to questions.

Punishment of up to Rs. 2000 per crime, and an additional fine of up to Rs. 100 per day from the first violation if non-compliance continues.

Deposits are accepted.

Up to three years in prison and a fine equal to twice the amount received.

In India, the NBFC market is quite large. Let’s Know more

The Non-Banking Financial Sector (NBFC) is a fast-growing industry. Although there are many banks in India, many areas remain untapped and have no banking services, which has resulted in increased demand for NBFC loans and, as a result, an increase in the number of NBFC registrations. Incorporation of non-banking financial companies (NBFCs) has exploded in recent years, and they are playing an increasingly crucial role in the financial sector's expansion. The key reason for this is the availability of tailored loan products, customer-friendly loan policies, speedier loan processing, advanced technology, and digital reach.

Non-Banking Financial Companies (NBFCs) have been able to secure a significant share of the banking and banking-related services industry. NBFCs operate in a similar manner to banks, however they do not provide all of the services that banks do. NBFCs can directly or indirectly raise cash from the public and freely lend them to final spenders. Despite the poor growth rate, we believe the NBFC sector will continue to grow due to enhanced technologies used by financial organisations.

License Cancellation Cases in NBFCs

RBI May Cancel NBFC Licenses for the Reasons Listed Below:

- If you don't have enough financial experience, your NBFC licence could be revoked.

- The business profile of the directors and shareholders is unsatisfactory.

- The business plan isn't up to par.

- Capital obtained from an illegal source.

- The consultants that work with NBFCs are inexperienced.

- The area in which NBFC operations are carried out is not encouraging.

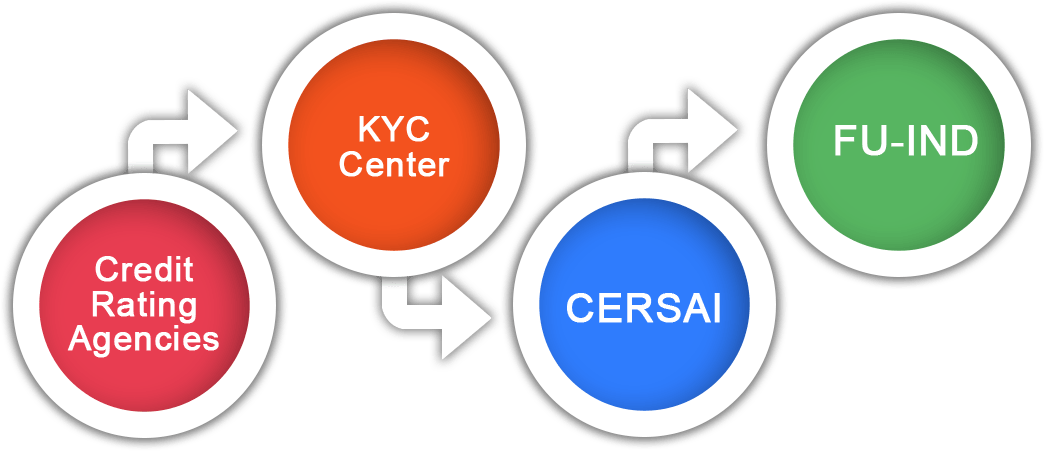

Mandatory Compliances after obtaining NBFC License from RBI

Prior to the start of the business, there are several formalities to do.

Following are the categories of Compliances that must be properly observed for subsequent activities after getting registration but before starting a firm.

The NBFC must submit an application for the following:

- CIBIL, ICRA, Equifax, and Experian are the four credit rating agencies with which you must register.

- KYC in the centre.

- Registration with CERSAI.

- Registration with FIU-IND.

- The Fair Practice Code has been adopted.

- E-Government Registration on a National Scale.

- Adoption of anti-money laundering and information technology policies.

- Information Utilities Financial Information Submission.

NBFC Annual Compliance

Following the above-mentioned registrations, NBFCs must adhere to the following requirements on an annual basis:

- The filing of an annual return with the Reserve Bank of India (RBI).

- Annual Return Filing and Financial Statement Filing are two statutory compliances with the Registrar of Companies (ROC).

- Income Tax Returns and GST Returns are two types of tax returns that must be filed.

Does RBI regulate all the Financial Institutions?

No, the Reserve Bank of India (RBI) does not manage or oversee all of India's financial institutions. The following financial institutions are classified as NBFCs but are not required to register under Section 45-IA of the RBI Act, 1935:

- Housing Finance Company;

- Companies engaged in merchant banking;

- Exchanges of stocks;

- Companies that participate in stockbroking activities;

- Companies that manage venture capital funds,

- Insurance businesses;

- Nidhi Enterprises;

- Chit Fund.

The above-mentioned steps can be used to legally and securely register an NBFC and reap the benefits of higher-quality sales and satisfied customers. Assisting you with NBFC Licensing and its compliance for the smooth operation of your financial business in India, our Biz experts are available to you at all times. Biz professionals will help you plan smoothly and efficiently at the lowest possible cost, ensuring a successful outcome.

An attorney with "financial experience" should be hired to avoid many of the pitfalls that lurk in the NBFC registration process and to fully understand the requirements of the registration process. To begin the process, you will need to provide the basic information. Upon receipt of all information and payment, the attorney will begin working on your request.

Why BIZ Advisors?

One such platform is Biz, which coordinates to meet all your legal and financial needs and connects you to reliable professionals in the field. The majority of our clients are happy with our legal services! Because of our commitment to simplifying legal requirements, they have consistently rated us highly and provided regular updates.

Our clients can also keep track of the progress on our platform at any moment. Our knowledgeable professionals are available to answer any queries you may have concerned the NBFC registration procedure. Biz will make sure that your interactions with professionals are pleasant and smooth.

- You must first complete the query form.

- Our specialist will contact you.

- Make the required payment.

- You will receive confirmation through email.

- Documents must be submitted to us.

- Your application will be processed by Executive.

- Keep track of the status of your order.

- Order has been fulfilled.

Biz Can Assist You with Other NBFC-Related Services After You've Registered:

- Advisory on Fintech-Based Lending Models.

- Creating a loan product and supporting documentation.

- Market strategy in its entirety.

- Fund-Raising Assistance

- Services provided by a virtual CFO.

- Post-Incorporation Requirements

- Expert Advice On IND-AS And IFRS Adoption

BIZ Process

Free Legal Advice

Transparent Pricing

On Time Delivery

Expert Team

Money Back Guarantee

200+ CA/CS Assisted

Lowest Fees

Easy EMIs

Frequently Asked Questions

Yes, under section 45-IA of the RBI Act, 1934, RBI registration is required for the establishment of an NBFC in India.

Different sorts of NBFCs are governed by different sorts of financial bodies, such as the RBI, SEBI, IRDA, and MCA, depending on their nature of activity. As a result, it is apparent that obtaining a licence from the RBI is not required for every NBFC, but they must apply for registration with their individual regulating agency.

9559179325

9559179325 9559179325

9559179325 9559179325

9559179325