An Overview Of The Hindu Undivided Family

HUF stands for Hindu Undivided Family. It is governed by Hindu Law. A HUF needs to be registered under the Hindu Undivided Family Registration. A HUF cannot be created by an agreement between two parties; it can be created by constituting a family by family members only. A HUF gets automatically formed when a person is married and starts his new life.

The Hindu Undivided family relation arises from status and not from legal contracts between them. Thus the relation here stands as the blood relation with the family members. Marriage, birth, and adoption are also included in HUF. The HUF has a distinct personality from its members and thus files separate income tax returns from its members and has separate PAN Card for all the members and the HUF itself. HUF can also be created by Buddhists, Janis, and Sikhs to file income tax. Here on this service page, we are going to discuss Hindu Undivided Family Registration in detail.

What is a Hindu Undivided Family?

HUF includes the entire male successor from a common male ancestor and their wives and unmarried daughters. HUF is managed by the head of the family known as “Karta”. He is the eldest male member of the family. HUF would continue even if Karta dies as his place could be taken by the next eldest male member of the family. Even when all the male members die, the HUF would exist and the eldest woman will be treated as Karta. The HUF is said to be a ‘person’ under the Income Tax Act. Thus it is a legal entity for the income tax.

Members of HUF

Following are the members included in HUF-

1. Karta

Karta is the eldest, particularly a male member of the family or the father of the family whose rights cannot be curtailed. He does all the things for the family and takes decisions for the legal and financial matters of the family accordingly and manages all the accounts of the HUF. The Karta of the family could also be any other member [except the eldest member] of the family if all the family members and co-parceners agree with it and gives their consent for it.

2. Coparceners

Coparceners are the other male member of the family whose right belongs to the property in the family from birth and are treated as HUF. The others [female] are treated as members of the family. The HUF could be extended to only 4 degrees of family hierarchy as mentioned below:

- 1st degree: holder of ancestral property for the first time [Father]

- 2nd degree: Sons and Daughters

- 3rd degree: Grandson

- 4th degree: Great Grandsons

If the Coparceners wanted to be part away with the family so they can demand their right to share property from the Karta.

Advantages of Hindu Undivided Family Registration

The Hindu Undivided Family Registration has the following advantages which are given below in detail-

- Separate Legal Entity

- Tax-free Gift

- Tax Savings

- Recognition

- Easily Avails Loan

In the eye of the Law, HUF has a separate legal entity. This permits the HUF to obtain separate filing of Income tax returns, and separate PAN Card and can open bank accounts in the name of HUF. All this is managed by the Karta himself or he assigns it to any other member of the family.

Gifts received by an individual/HUF are treated as tax-free. But it shall not exceed the monetary value of INR 50 thousand in the form of cash, cheque or draft, etc. The Karta of the family giving gifts to her daughter during her marriage is also exempted from the tax purpose.

A HUF has a separate PAN Card and thus the income of the family is taxed on that PAN Card the members of the HUF file taxation separately thus exemptions and deductions are allowed to both separately under the Income Tax laws. Thus tax could be saved in this way by the HUF.

The HUF has been recognized all over India except in Kerala. Thus the benefits arising from HUF could be availed in any part of India. HUF is not created through contract but rather by being in a family. It is created automatically after the solemnization of marriage takes place, adoption, or newborn into a family.

A HUF would easily avail of a loan benefit due to its identity as HUF. Although the loan can be restricted to the member's portion of the property by the Karta.

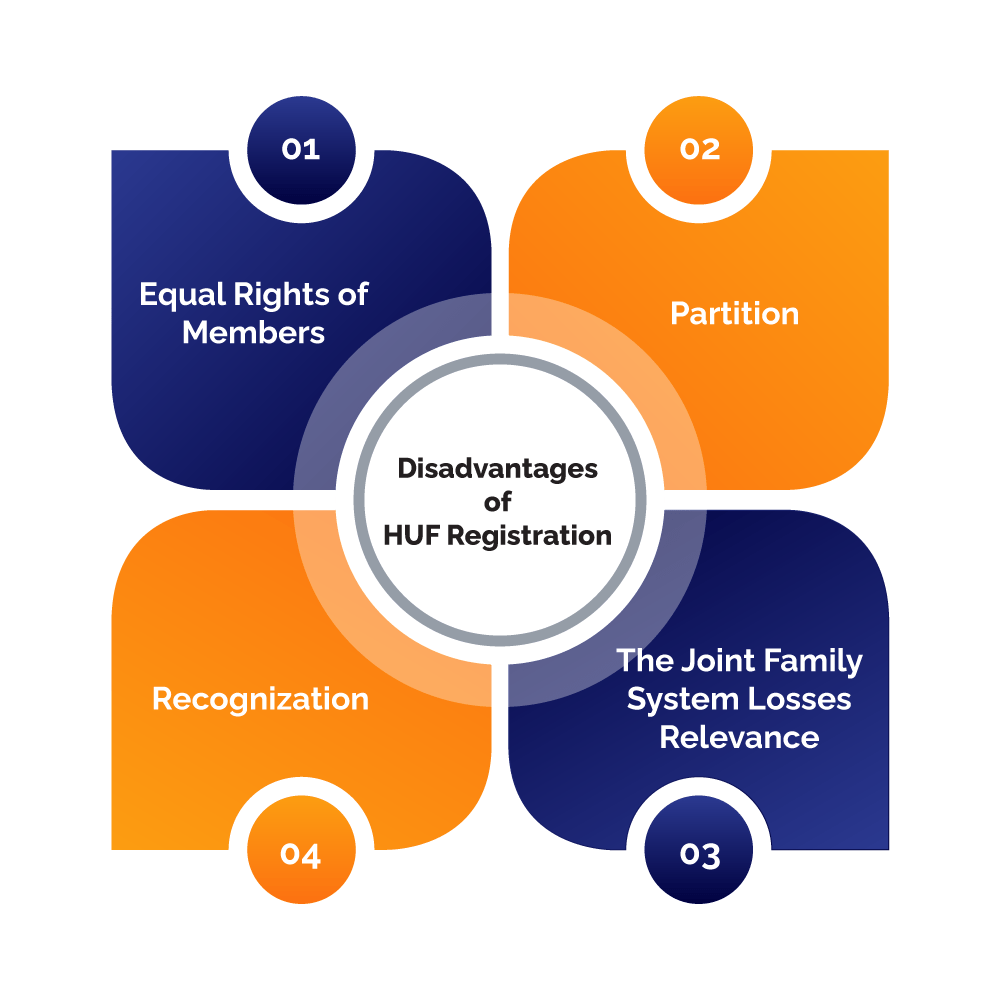

Disadvantages of Hindu Undivided Family Registration

Hindu Undivided Family Registration has also some demerits which are given below-

- Equal Rights of Members

- Partition

- The Joint Family System Loses Relevance

- Recognition

The members of the HUF entitle to equal rights on the property, that’s the biggest disadvantage of HUF. Marriage or Birth in the family includes that member as a HUF member and gets equal rights as other members. The common property of the HUF cannot be sold out without the consent of other members. In absence of consent from any member would halt the sale deal till consent is received. A HUF would get large to manage by the Karta.

Starting a HUF is an easy task but the same would prove as a nightmare while closing it. As all the members should convince of the partition which would dissolve HUF. While partition, the assets are distributed among the members of the family which sometimes leads to chaos and conflict and arising of legal hassle.

In today’s generation, it is quite common among couples or other family members to fight over silly household expenses, which sometimes leads to great conflict and results in the dissolving HUF. That’s a great disadvantage as HUF is considered a separate tax entity that provides HUF benefits while filing taxes. Thus HUF is losing its importance for tax filing.

The recognition of HUF also turns to cons sometimes as it is recognizable in India only and not abroad. As Indians move to other countries for education purposes or the job, the income assessment becomes difficult for them to access.

Conditions to be Met for Hindu Undivided Family Registration

For Hindu Undivided Family Registration following conditions must be met-

- HUF can be only formed by a family

- A HUF is automatically created as any new member is added to the family i.e. through marriage or birth

- HUF consists of a common ancestor and all of his descendants including their unmarried daughters and wives

- For HUF, Buddhists, Janis, Sikhs, and Hindus are eligible to form HUF.

- HUF should have a legal deed. The deed shall enlist details of the HUF members and the business of HUF.

- Once the HUF is registered, the PAN number and bank account number should be opened in the name of the HUF.

List of Documents required for HUF Registration

The following is the list of documents required for Hindu Undivided Family Registration-

- Pan Card of Karta.

- ID Proof [Driving License/Aadhar Card/Passport/Voter ID] of Karta.

- Electricity Bill or any other utility bill for the address proof of Karta.

- Passport-size photographs of Karta.

- Signatures of the Karta, the Co-parceners, and the members of a HUF.

- HUF Deed.

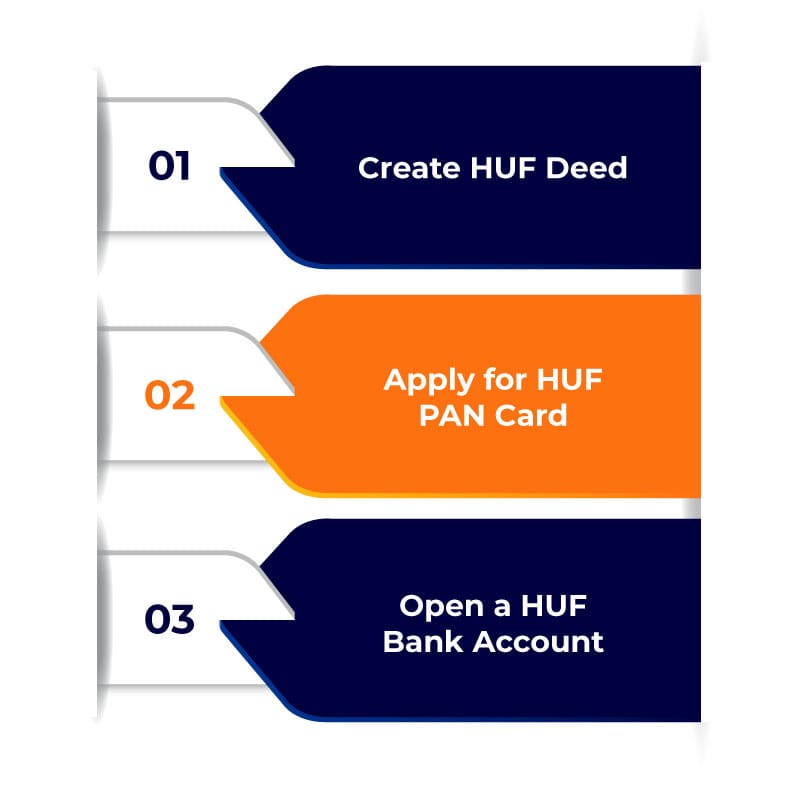

The Procedure of Hindu Undivided Family Registration

Following are the steps given below to get the Hindu Undivided Family Registration-

Step 1:Create HUF Deed

To create HUF, firstly HUF Deed shall be created. The HUF Deed is a written formal document on stamp paper expressing the names of the Karta and the Co-parceners [Members] of the HUF. The eldest male member of the family becomes Karta of the HUF or as decided by the co-parceners and the members.

A declaration is made by each family member where they declare the following:

- Name of the Karta.

- Karta has the solemn authority given to the accounts of the HUF.

- Total members of the HUF.

- The capital amount that was used while the HUF was established.

- Karta holds the right to govern all the transactions of the HUF accounts on behalf of the members.

In the HUF Deed, the name of the HUF is also required to be stated at the time of the creation of the HUF Deed. The name of the HUF is the name of the Karta, with the suffix HUF. For example: if the name of the Karta is Mohit Dhamecha, then the name of his HUF would be Mohit Dhamecha HUF.

Step 2: Apply for HUF PAN Card

A HUF is treated as a separate legal entity from its members in the eye of the law thus it needs to apply for a separate PAN Card. A separate form is prescribed for HUF PAN Card i.e. Form 49A, which can be filed physically as well as online.

When the PAN Card is allotted, the HUF can file separate Income Tax returns under his name. Now the HUF can claim benefits and allow deductions under the income tax laws. The application shall be signed by the Karta of the PAN Card and Income Tax Return.

Step 3: Lastly Open a HUF Bank Account

A bank account shall be opened for HUF in which all the payments of HUF shall be maintained. The bank account can be opened in any bank for HUF purposes. At the time of the creation of HUF, while opening the bank account, the HUF would require a Rubber stamp of the HUF and all other documents relating to HUF shall be properly stamped accordingly.

When all the above three steps have been completed, the HUF now holds a separate legal entity and from the time the amount received in the name of HUF will not be taxed as individual members of the HUF, it would be separately taxed for the HUF.

HUF Registration as a Tax-Saving Tool

In India, the tradition of the Hindu Undivided Family lasted for many years back, and yet in some areas, it is prevalent now also. The incomes earned by this HUF are treated as joint income of the family. As these are treated as joint income thus ITR couldn’t be filed by a specific individual name thus HUF has its different legal identity and tax is filed separately by the HUF.

Thus HUF acquire an additional PAN Card in its name, which is legally acceptable in India. Once the HUF is created the members of the family will not be liable to pay individual taxes for HUF. The reason for forming a HUF is to save tax and gets an extra PAN Card legally. By this, benefits of Income tax slab rates are availed by the whole family. As income is tax-free for a specified limit and later it would tax progressively.

HUF Tax System

- HUF has to file Income Tax Return every year and if the turnover of the business of HUF is more than 25 lakhs or 1 crore, a tax audit is required to be conducted under section 44AB.

- The due date for filing the ITR of the HUF would be 31st July of every assessment year. But where the tax audit has to be conducted, the due date would be shifted to 30th September.

- As Karta has all the powers to sign documents for HUF. But he may also permit any other members to have this power for a time period or as prescribed accordingly.

BizAdvisors Assistance for Hindu Undivided Family Registration

Kindly utilize the steps given to integrating legally and securely a Hindu Undivided Family Registration. Our Bizadvisors experts will be at your disposal for assisting you with guidance concerning Hindu Undivided Family Registration and its compliance for the smooth functioning of your HUF in India. Bizadvisors professionals will guide you in planning a pocket-friendly budget.

Why BizAdvisors?

BizAdvisors is one of the platforms that work together to meet all of your legal and financial needs while also connecting you with dependable specialists. Yes, our clients are happy with the legal services we provide. They have continually regarded us well and provided regular updates because of our focus on minimizing legal requirements. Our clients can also keep track of the progress on our platform at any moment. Our knowledgeable professionals are here to answer any queries you may have concerning the Hindu Undivided Family Registration . BizAdvisors will make sure that your interactions with professionals are pleasant and smooth. Following are the reasons one should choose Bizadvisors-

- BizAdvisors is one of the many platforms which coordinate to fulfill all your legal requirements.

- It connects you with a team of expert professionals who can help you in every possible way.

- Its focus is on simplifying the legal requirements for the client.

- If you have any questions regarding Hindu Undivided Family Registration we are just one phone call away.

- We have a very dedicated team that is ready to help you and guide you.

- Our mission is to create a hustle-free and easy-to-use system for the concerned consumers of our services.

- We give you reliability and trust.

- We make sure that we will provide you with the best services and can satisfy you with our quality work.

HUF Registration avails great benefits to families in India. But most people are yet not aware of it. The one who knows about it enjoys the advantage arising from it. Conclusively it could be said as HUF is simple to adopt but carrying for the long term is challenging. Thus it requires due care to start a HUF. As it has merits as well as demerits associated with it. Proper management in the HUF can avail a great advantage to the family as a whole.

Karta needs to make wise decisions and balance the HUF accordingly. Sometimes the demerits overlap the merit part of it and that can lead to conflicts in HUF. Any quarrel or dispute in the family would make a big loss and could end HUF. Thus today, HUF has lost its identity due to conflicts between the family members. If you want to get register your Hindu Undivided Family, you can contact our experts from BizAdvisors for any query related to it.

Frequently Asked Questions

One person cannot form HUF; it can be formed by a family. A HUF gets created at the time of marriage. A HUF consists of a common ancestor and all of his lineal descendants, including their wives and unmarried daughters. Hindus, Buddhists Janis, and Sikhs can form HUFs.

Following are the Account opening documents for HUF:

- Bank account details of HUF. Bank account details should be in the name of HUF.

- Photograph of Karta

- Proof of identity of the Karta [Aadhar Card/Pan card/ Voter id]

- Proof of address of the Karta[ Aadhar card/ Voter id/ electricity bill]

- PAN number in HUFs name

- The entire co-parceners name in the HUF family shall be mentioned, along with the authority given to the Karta for operating the accounts of HUF.

- Bank Account details shall be attested as proof - from the below mentioned any one of the documents could be attested:

- Copy of bank statement

- A copy of the first page of the bank passbook is also required

- A canceled cheque [only if the account holder’s name is printed on it]

Basically, the logic behind forming a HUF to save tax is to avail the benefit of an extra PAN Card legally. As the Income of the Family is not taxed in the hands of any specific individual, a new PAN Card is allotted to the HUF and tax would be paid by the Family using this PAN Card.

On the death of a Karta, the next senior member automatically becomes the new Karta of the HUF but at times, statutory authorities may require a declaration from the members of the HUF stating the new Karta of the HUF.

No, HUF cannot have Aadhar Card. An Aadhar card is provided to only individuals and not to any entity such as HUF. If required, Karta needs to showcase his Aadhar card as required.

To form a HUF, it is essential to have a child. The HUF could be formed with a child irrespective of male or female. In the case where a partition is laid down in the HUF, the partitioned small HUF could be formed out without a child.

The HUF could be formed by one male member. There is no need for two male members in it. For forming a HUF, the requirement is for the Karta, the Co-parceners, and the members. Although a married couple would form a HUF of their own.

Yes, daughters are given the right same as sons for being a Karta of the HUF. This is so because of the amendment in the Hindu Succession Act in 2005. Earlier the daughters were not availed of such a position.

9559179325

9559179325 9559179325

9559179325 9559179325

9559179325