Overview of FFMC License

Individuals and businesses interested in dealing in foreign currencies must first obtain an FFMC licence from the Apex Bank, the Reserve Bank of India. The holders of such a licence have the power to buy foreign exchange from NRIs (Non Resident Indians) and sell it to Indians going abroad for business and travel.

Only an AMC (Authorized Money Changer) is eligible to deal in the operations of Money Changing and Foreign Exchange, according to the laws and conditions of Section 10 of the FEMA 1999.

The RBI has also granted some companies and hotels Full Fledged Money Changer Licenses to trade in Foreign Currency, Traveler’s Cheque, and Coins. To avoid issues for foreign tourists and visitors, the same is done.

Authorized Money Changers' Role in Foreign Exchange Transactions

Authorized money changers play a critical role in foreign exchange transactions. The Reserve Bank of India issues licenses to banks that allow them to engage in foreign exchange activities. Only those banks that are well qualified to conduct foreign exchange transactions in India are awarded this licence.

It should also be mentioned that, in addition to banks, the apex bank authorizes certain financial entities to conduct certain forms of foreign exchange operations that are unrelated to their primary activity.

The advantages of having an FFMC Licence

The following are the main advantages of obtaining a Full-Fledged Money Changer License:

- An AMC Licensee has the capacity to provide foreign exchange sale facilities and services.

- In the event of Travelers Cheque, Foreign Currency Notes from Non-Residents and Residents, an FFMC licence holder can offer encashment certificates.

- International exchange operations for foreign visitors visiting India can be carried out by an FFMC License Holder.

- An AMC License Holder can deal with coinage, travelers’ checks, and foreign currencies at the current exchange rate.

Full-fledged money changer licenses come in a variety of forms

The following are the many types of Full-Fledged Money Changer Licenses:

Requirements for Obtaining a Money Changer's Licence.

The following are the requirements for applying for a Money Changer License in India:

- The business entity that applies for an FFMC License must have been lawfully incorporated under the Companies Act of 2013.

- In the case of a single branch, the company must have a NOF of at least Rs 25,00,000. (Net Owned Funds).

- If the company has many branches, the NOF must be at least Rs 50,00,000. (Net Owned Funds).

- The goal clause of the MOA (Memorandum of Association) must include money-changing activities.

- The company must not be involved in any ongoing investigations by the Department of Revenue Intelligence or the Department of Enforcement.

- It is required that the company begin operations within six months of receiving an AMC License from the RBI.

Authorized Money Changer License Regulatory Framework

Authorized Money Changer Licenses are issued by the Reserve Bank of India, which has absolute jurisdiction. In addition, the Apex Bank has the authority to issue the following directions and guidelines for AMC License-related matters:

- New AMC licence is issued.

- AMC License Renewal.

- Branch Licensing is a term used to describe the process of obtaining a licence

- The importance of KYC (Know Your Customer) cannot be overstated.

- Anti-Money Laundering (AML) is an important matter.

- Appointment of Franchisees or Agents requires approval.

- CFT (Combating Terrorism Financing) Norms

- Guidelines for Authorized Persons (AP).

What FFMC Activities are Permitted by the RBI?

The following are the RBI-approved FFMC activities:

An AMC or FFMC is eligible to enter into Franchise Agreements for the limited money changing activities, such as the conversion of foreign currency notes and coins, traveler's checks into Indian currency, and so on.

Both residents and non-residents can acquire Traveler's Cheques, Foreign Currency Notes, and Coins with an FFMC License.

An AMC License holder may sell Indian currency to foreign guests, visitors, or tourists using international debit and credit cards. Also, the same can take the necessary steps to get reimbursement through a traditional banking channel.

An FFMC is permitted to sell foreign money for the following purposes:

- Personal Visits.

- Visits for business.

- Prepaid Forex Cards.

Documents Required for an FFMC License Application

The following are the documents needed to apply for an FFMC licence:

- A copy of the COI is available upon request (Certificate of Incorporation).

- A copy of the MOA (Memorandum of Association), which contains the applicable provisions for Money Changing Business activities.

- A copy of the AOA (Articles of Association), which contains the necessary provisions regarding Money Changing Business activities.

- A copy of the most recent audited financial statements, as well as certificates from the Statutory Auditors certifying the NOF as of the application deadline.

- A copy of the most recent audited financial statement.

- A copy of the Profit and Loss Account for the last three years.

- The applicant's bank's sealed confidential report.

- Details on all associated/sister companies, such as NBFCs, that operate in the financial industry.

- A fully attested copy of the Board Resolution passed for conducting money-changing business operations.

How to Get a Full-Fledged Money Changer License from the RBI

The following are the stages involved in acquiring a Full-Fledged Money Changer License from the RBI:

Make a request to the Reserve Bank of India

In the first step of the procedure, the applicant company must submit an application in the approved format, along with the requisite documentation, to the Apex Bank's regional office. The RBI's prescribed format is covered in Annexure-II.

Fit and Proper Criteria must be met

A corporation must meet Fit and Proper Criteria in order to obtain an authorized Money Changer License from the Reserve Bank of India. As a result, the Board of Directors must go through the Due Diligence process to ensure that the statutory Fit and Proper standards are met.

In addition, one of the key roles of the Fit and Proper Criteria is to aid in determining the knowledge, integrity, qualifications, and past track record of the individual suggested for appointment as Director.

Fit and Proper Criteria's Key Requirements

The Fit and Proper Criteria's main requirements are as follows:

- The proposed individual must not be older than 70 years old.

- He/she must not be a Legislative Assembly Member.

- There must be no prior history of unethical behavior.

- He/she should not be a member of Parliament (Member of Parliament).

- There should be no prior criminal records.

- Regulatory Bodies must not have sanctioned or granted permission.

Obtain permission from the Empowered Committee

The directors of the applicant company must next get clearance from the EC as the following stage in the process of obtaining an AMC License (Empowered Committee). It should be stressed, however, that this will be based solely on adequate verification.

The Reserve Bank of India conducted a review

The company's application and paperwork will now be reviewed by the Reserve Bank of India. If the RBI determines that the application and documentation submitted meet the fit and suitable conditions, it will give the applicant an Authorized Money Changer or FFMC License within 2 to 3 months.

Start-up of business operations

After receiving a Full-Fledged Money Changer licence, the business entity must begin commercial activities within six months of the license's issuance date.

Furthermore, before beginning business activities, the stated firm must submit a duplicate copy of the Possession Certificate, Shop and Establishment License, and Lease Agreement to the Reserve Bank of India.

What are the FFMC License's Post-Approval Requirements?

The following are the Post-Approval Registration Requirements for a Full-Fledged Money Changer License:

- Before beginning business activities, the directors of the application company must submit a duplicate copy of the Possession Certificate, Shop and Establishment License, and Lease Agreement to the Reserve Bank of India.

- All orders, guidelines, and circulars issued by the Apex Bank must be followed by the applicant company.

- A copy of the obtained Money Changer License must be displayed at every location where the licence holder's registered office is located.

- The applicant organization must implement a comprehensive Concurrent Audit framework in order to conduct foreign exchange transactions and operations in a seamless and hassle-free manner.

- At the RBI's regional office, the registered licence holder company must submit its Annual Audited Balance Sheet and Profit and Loss Account for the previous three years.

Concept of Franchise

The term "agents" or "franchisees" refers to the fact that the RBI has permitted more than one middleman to engage in foreign exchange activities.

Additionally, Authorized Dealer Category-I Banks, Authorized Dealer Category-II Banks, and FFMCs may appoint Agents and Franchisees to engage in money-changing activities.

The following are some things to keep in mind in this regard:

- Any business organisation with a presence in India can become a franchisee or an agent.

- A minimum NOF (Net Owned Funds) of Rs 10 lakh is required for such a corporate entity.

- Only the restricted money changing business is permitted for franchisees.

- Between the parties, a Franchise Agreement will be signed.

- Franchisees must prominently display the names of their Franchisers, current exchange rates, and the fact that they are only authorized to purchase foreign currency in their offices.

- The foreign money obtained by a Franchise shall be relinquished to its Franchiser only within seven working days of the date of acquisition.

- It is a necessity for every franchisee to maintain adequate records of transactions.

Revocation of Authorized Money Changer License

The Reserve Bank of India has the ultimate authority to revoke, suspend, or cancel an Authorized Money Changer License that has been issued in India. In the following scenarios, the same is possible:

- In the general Public's Interest and Welfare

- If an Authorized Money Changer is unable to properly comply with the FEMA Act 1999's statutory obligations as well as the RBI's circulars, guidelines, and recommendations.

It should also be noted that the Apex bank maintains the right to change, modify, or revoke any of the current terms, conditions, or rules governing AMC License in India.

Procedure for renewing the FFMC licence in India

To renew an expired FFMC or Full-Fledged Money License, the License Holder Company's directors must file an application for renewal one month before the license's expiration date.

However, if the company is unable to submit the renewal application within the specified time frame, the RBI will reject it when it is filed.

It is important to note that the previously issued licence will continue to be valid until the company receives the rejection notification. However, following the expiration date, the mentioned company will be ineligible to submit a licence renewal application.

FFMC License Holders are required to keep a variety of Records and Registers

An Authorized Money Changer must keep the following registers and records for their money changing transactions:

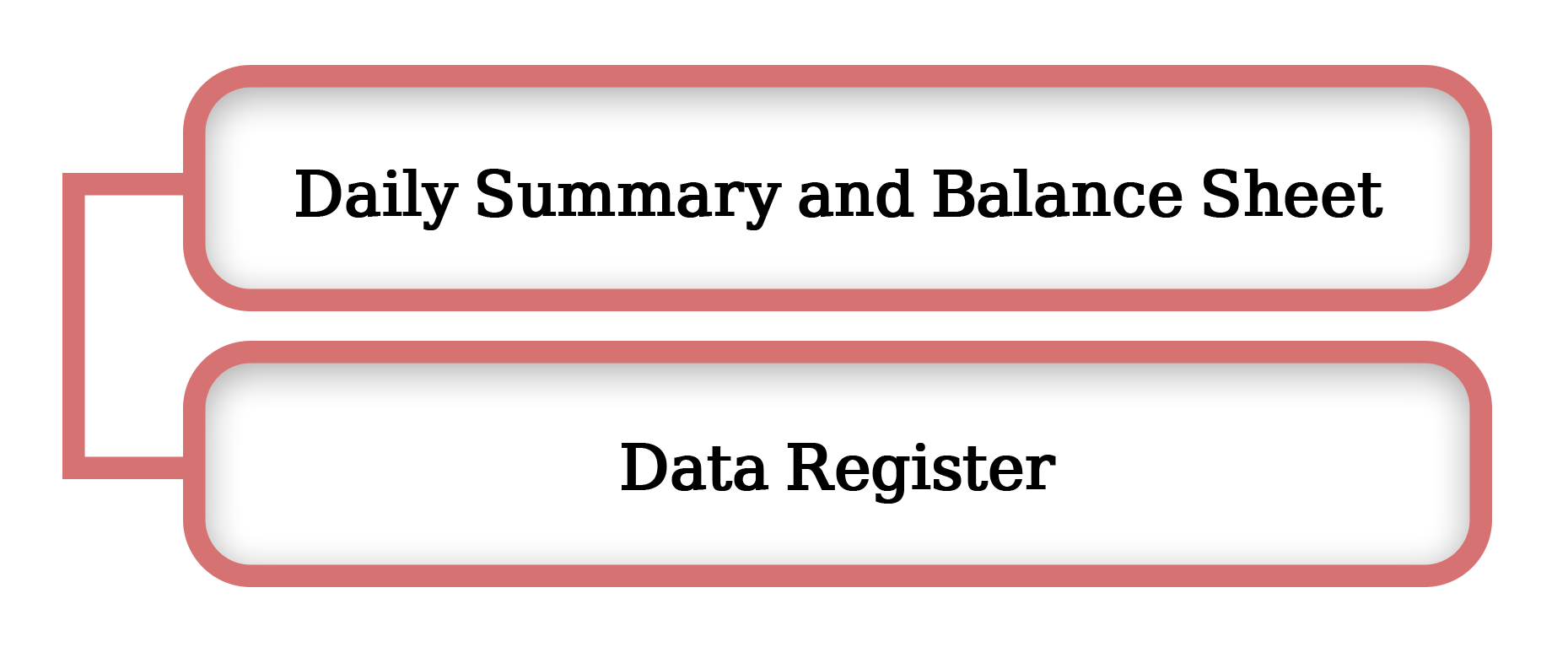

Daily Summary and the Balance Sheet

The daily summary and balance book must include the following information:

- Form FLM 1 foreign currency notes or coins

- Form FLM 2 is a traveler’s check.

Data Register

The following items must be included in the data register:

- Form FLM 3 is used to purchase foreign currencies from the general public.

- Purchase of foreign currency notes or coins in Form FLM 4 from authorized money changers.

- Form FLM 5 is used to sell foreign currency notes or coins to the general public.

- Form FLM 5 is also used to sell foreign currency travelers’ checks.

- Form FLM 6 sale of foreign currency notes or coins to authorized full-service money changers or foreign banks

- Form FLM 7 contains information on the surrendered Travelers’ check to authorized money dealers / full-fledged money changers or exporters.

Why Choose Us

Free Legal Advice

Transparent Pricing

On Time Delivery

Expert Team

Money Back Guarantee

200+ CA/CS Assisted

Lowest Fees

Easy EMIs

Frequently Asked Questions

There are three different types of FFMC licences:

Authorized Dealer Category 1 (Banks), Authorized Dealer & Full-Service Money Exchangers (FFMC).

Before beginning business, submit all of these copies to the RBI Regional Office.

A copy of the lease agreement; a copy of the store registration; and a copy of the rent receipt or the Establishment Act.

9559179325

9559179325 9559179325

9559179325 9559179325

9559179325