Overview of Insurance Web Aggregator License

A web aggregator in India gives information on the numerous insurance packages available from insurance firms. Buyers can evaluate different insurance products, as well as their features and prices, using insurance web aggregators. However, before beginning any aggregation activities through their website, these web aggregators must first get the Insurance Web Aggregator License.

The primary goal of introducing Insurance Web Aggregators in India was to educate and inform consumers about the various insurance products available. People used to visit insurance agents before purchasing any insurance policies, and agents used to charge a substantial commission for their services.

As a result, the IRDAI devised the notion of establishing a transparent, digital, and highly regulated platform to reduce insurance agents' unethical practises of charging extra commissions. Insurance Web Aggregators also allow customers to compare policies, allowing them to make more educated decisions about their insurance needs.

Concept of Insurance Web Aggregator

An insurance web aggregator gathers, organises, and retains information on various insurance products offered by different insurance firms. All of the information gathered by the web aggregator is made available on its online site for consumers seeking insurance services to easily access. Furthermore, the IRDAI enforces regulations that govern the Web Aggregator's duties (Insurance Regulatory and Development Authority of India). The Insurance Web Aggregator concept is likewise governed by the provisions of the Insurance Act as well as the Companies Act.

In order to function as an Insurance Web Aggregator in India, a company must first obtain an Insurance Web Aggregator License from the IRDAI. On a website, insurance web aggregators collect, organise, and present information about various companies' insurance policies. They serve as a link between insurance firms (insurers) and those looking to purchase insurance policies.

The insurance web aggregator is a company that runs a website that offers information on insurance policies offered by various insurance firms in the market. The Insurance Regulatory and Development Authority of India (Insurance Web Aggregators) Regulations, 2017 (“Regulations”) governs their activities.

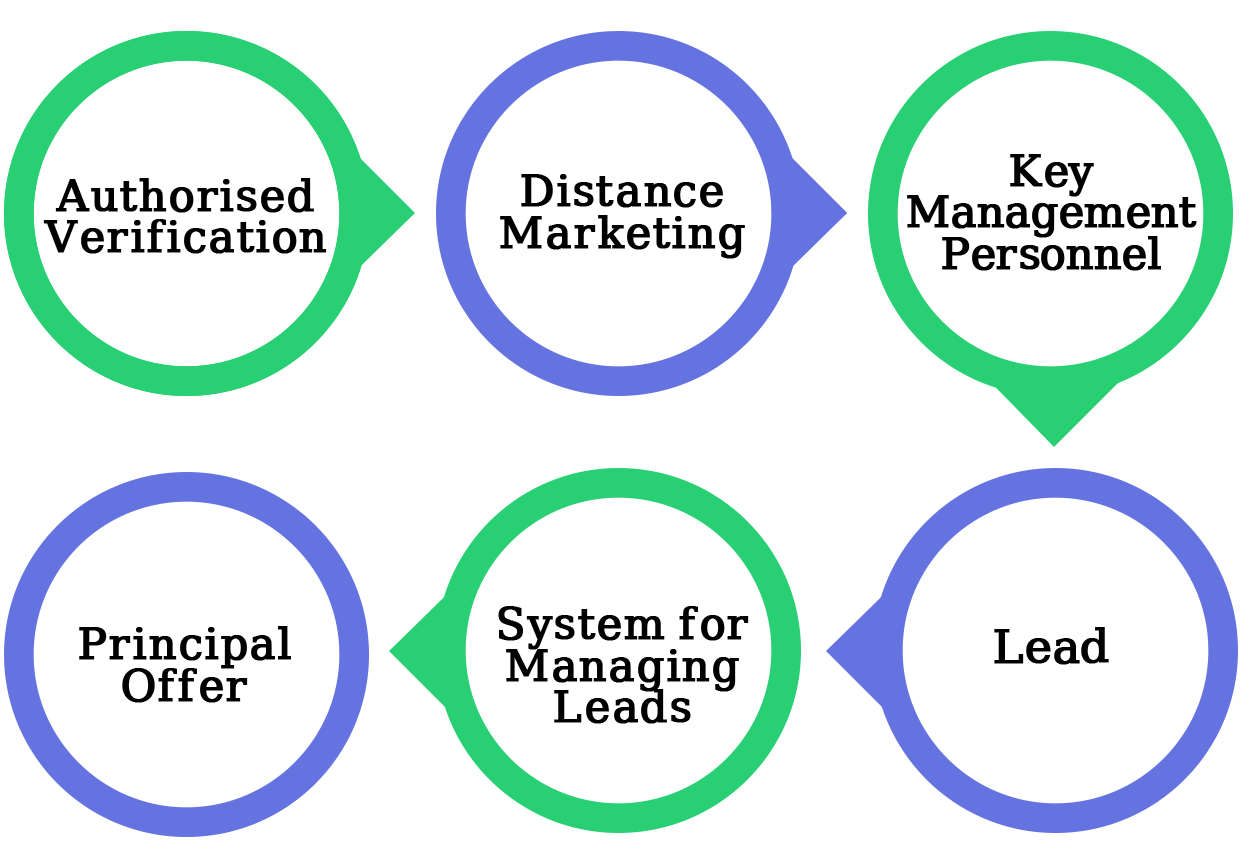

Terminology to Know

Authorised Verifier

Individuals who work for a web aggregator, an insurance company, or a Tele-advertiser with the purpose of selling and acquiring insurance through Telemarketing and Distance Marketing, and who have prepared for and passed the IRDAI examination;

DistanceMarketing

It refers to the process of providing insurance products to clients without requiring their physical presence, and it is carried out over the phone, SMS, email, or other Internet or web administrations;

Key Management Personnel

The KMP denotes the Chief Executive Officer (CEO), Chief Operating Officer (COO), Chief Marketing Officer (CMO), Chief Financial Officer (CFO), Head of Technical, and Head of IT, according to these principles.

Lead

It refers to information identifying an individual who has visited an insurance web aggregatorwebsite and provided specific contact information in order to obtain information on the pricing, features, or benefits of various insurance products;

System for Managing Leads

In this process, the registered insurance web aggregator uses software to perform tasks such as recording, filtering, validating, grading, distribution, follow-up, and conclusion of leads generated by insurance web aggregatorinquiries.

Principal Officer

He or she is the person in charge of the web aggregator's overall operation, and may be a Director, Shareholder, or Promoter, among other things.

Eligibility Criteria for the Insurance Web Aggregator License Certificate of Registration

- The most important factor to consider is that the candidate will meet the individual criteria, which means that the candidate will either be a company registered under the Companies Act of 2013 or a limited liability partnership (LLP) formed under the LLP Act of 2008.

- The proposed web aggregator organization's Memorandum of Association will include the business of web aggregation of Insurance Products as its primary item.

- Non-inclusion in any other business than that of a web aggregator for protection.

- The candidate will not be a corporate specialist, insurance operator, small-scale insurance operator, assessor, or loss assessor, insurance advertiser, or any other IRDAI-registered insurance middleman.

- There should be no agreement between the insurer and the candidate regarding referrals.

- The candidate should have an allotted site where he or she can conduct the activities of an insurance online aggregator.

- There should be a designated Principal Officer with a minimum defined qualification, important training, and successful completion of the prescribed online test.

- The Authority will not have rejected any web aggregator applications submitted by the contender in the previous fiscal year. Conditions for Obtaining a License

Conditions for Obtaining a License

- According to the law, the Insurance Web Aggregator License company is engaged in the request of insurance goods.

- All elements that are registered as web insurance aggregators must follow all rules and regulations, as well as the authority's notifications and information.

- Any significant change in the material data provided to the authority will be reported promptly.

- There is a system in place for properly resolving client complaints. Within 14 days of receiving the complaint, the grievance is heard.

- There is a good system in place for keeping track of the insurance policies that have been solicited.

- The web aggregators will provide their Directors, Promoters, Shareholders, and others with a genuine set of principles.

Investment Requirements

- Any candidate seeking enlistment under the IRDA (Web Aggregator) Regulations,< 2017 must have a net worth of INR twenty-five lakhs in total assets/settled up capital.

- The capital will be supplied and bought in as Equity Shares if the proposed Insurance Web Aggregator is an entity enrolled under the Companies Act, 2013.

- If a Limited Liability Partnership (LLP) is formed, the partners' commitment will be in the form of money.

- The shares will not be sworn in any way to ensure credit or any other office, and they will be unaffected at all times.

Requirements for Net Worth

An Insurance Web Aggregator’s total asset will never fall below 100 percent of the minimum capital requirements after the certificate of registration is obtained.

Each Insurance Web Aggregator will examine the status of its entire assets twice a year, on the 30th of September and the 31st of March.

Every year, when the books of records are closed, a net worth certificate duly validated by a Chartered Accountant will be presented to the Authority.

Application for registration as a Web Aggregator

- Form A of Schedule-I of the IRDA (Web Aggregator) Regulations, 2017 will be used to submit a complete application for enlistment.

- The application will be submitted along with a non-refundable fee of INR 10,000, which will be paid in the name of the Insurance Regulatory and Development Authority in India via Demand Draft or electronic funds transfer.

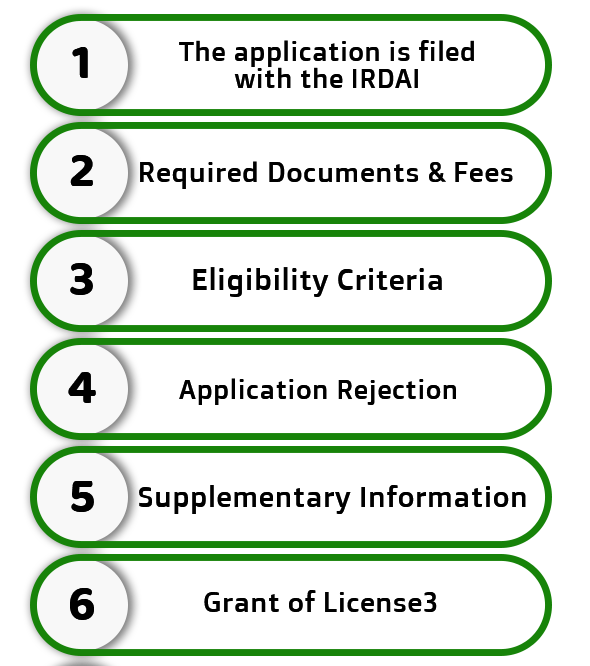

The Registration Granting Process

The following are the stages involved in getting Insurance Web Aggregator Registration:

The application is filed with the IRDAI.

An applicant for an insurance web aggregator licence must fill out Form A of Schedule I of the IRDAI Regulations and submit it to the IRDA.

Required Documents and Fees

The application, along with the required documentation, must be filed by the company's directors. They must also pay a cost of Rs 10,000 plus any applicable taxes. The charge must be paid to the IRDAI in the form of a DD (Demand Draft).If an application is submitted without paying the application fee, it will be rejected. Furthermore, every application must be accompanied by a detailed five-year business plan for the company. In addition, the business plan must include a strategy and financial estimates.

Criteria for Eligibility

Before submitting an application for an insurance web aggregator licence, the applicant must ensure that the company fits all of the eligibility requirements. If the applicant company wishes to do telemarketing and outsourcing tasks, it must state so in its registration application.

Application Rejection

The authority has the right to reject an application that does not meet the IRDAI's requirements. If there is any omission or failure, the authorities will give the applicant corporation thirty days to correct all errors before rejecting it.

Supplementary Information

The Authority may also request that the applicant company provide more information or clarification on any details or documents it has submitted. Furthermore, responding to IRDAI's questions is a multi-stage process. For a single enquiry, a corporation may need to submit many responses. If the applicant fails to respond after thirty days of receiving notification, the authority has the ability to reject the application, and the applicant corporation must file a new application.

Grant of License

If the Insurance Regulatory Development Authority in India is satisfied that all of the information and papers supplied are accurate and correct, it will issue a certificate of registration to the applicant company. It must also believe that granting such a licence is in the best interests of insurance policyholders.

Renewal of Registration

- The application for reestablishment must be submitted at least 30 days prior to the expiration of the permission term granted by the Authority.

- The application for reestablishment shall be accompanied by a fee of INR 25,000 and will be completed in all respects, as well as any necessary archives.

- Without a major endorsement of enlistment from the Authority, no Insurance Web Aggregator is permitted to fulfil the elements of the Insurance Web Aggregator.

An Insurance Web Aggregator's Scope of Work

At least one of the following exercises will be delivered by the protection web aggregator, who holds a considerable certificate of registration:

- On the site, item correlations are displayed.

- The backup plans are transmitted via prompts.

- Protection on the internet is available as a service.

- Protection offered by telemarketing or other computerised advertising methods.

Insurance Web Aggregator's Earned Income

- Transmission of leads from a protection web aggregator to a safety net provider will be free of charge.

- He must pay a flat fee of not more than $50,000 per year for each item displayed by the Insurance Web Aggregator in the examination outlines of its website.

- The Authority's representation of several other charges.

Rejection of Application for Registration

The Authority will reject the application for registration as insurance online aggregators on the following grounds:

- Data that is fragmented or not authentic.

- Inability to provide the Authority with the requested data within 30 days of receiving it. In this instance, the application will be treated as if it were non-accommodation.

Insurance Web Aggregator License Validity Period

The Insurance Web Aggregator License certificate is valid for three years from the date of the IRDAI's issuance of the licence (Insurance Regulatory Development Authority of India). The web aggregator must renew its licence at least thirty days before the three-year period expires by filing an application and paying Rs 25000 in costs.

Why Choose Us

Free Legal Advice

Transparent Pricing

On Time Delivery

Expert Team

Money Back Guarantee

200+ CA/CS Assisted

Lowest Fees

Easy EMIs

Frequently Asked Questions

Submission of fake and unauthentic documents, inability to provide details and documents requested, and noncompliance with the regulations are all grounds for rejection of an application for an Insurance Web Aggregator License.

The benefits include easy comparison of insurance policies; contact with each service provider without having to meet in person; a level playing field; and saving clients' time and energy spent gathering information about various insurance policies.

9559179325

9559179325 9559179325

9559179325 9559179325

9559179325