Overview of Alternative Investment Fund Registration

Alternative Investment Funds, or AIFs, invest in a variety of start-ups and businesses. Before starting an Alternative Investment Fund, the applicant or candidate must register with SEBI, the Securities and Exchange Board of India (AIF).

The SEBI (Alternative Investment Fund) Laws, 2012 are a collection of regulations enacted by SEBI (Securities and Exchange Board of India) in 2012 with the goal of regulating joint investment funds in India, such as private equity, real estate, and hedge funds. Such regulations were enacted in order to bring unregistered monies under the control of the law. A fund constituted in the form of an entity is referred to as an ALF in this regulation.

What is an Alternative Investment Fund, and how does it work?

Alternative investments encompass a wide range of asset types that are not available through typical investment vehicles such as equities and bonds. Hedge funds, private equity, real estate, commodities, infrastructure, and other alternative investment funds fall into this category.

Alternative Investment funds are a type of pooled investment vehicle in which investors combine their money to participate in a variety of atypical investment possibilities. Anyone in India who wants to put money into an alternative investment fund can do so through SEBI-registered AIF businesses.

A group of competent individuals forms a fund and raises funds from approved investors in order to invest in lucrative investment possibilities.

These investors can be either domestic or international. The SEBI-registered AIF can take the form of a trust, a limited liability partnership, or a corporation. Traditional investing options have a distinct character and risk than AIF investments. An AIF's registration is valid for the duration of the AIF's existence.

What are the Different Types of Alternative Investment Funds?

The different types of Alternative Investment Funds (AIF) are as follows:

Category 1

AIFs that invest in early-stage or start-up ventures, social ventures, SMEs, infrastructure, or other sectors or areas that the government or regulators consider to be socially or economically desirable, including venture capital funds, SME funds, social venture funds, infrastructure funds, and other Alternative Investment Funds as may be specified.

Category 2

These funds are not permitted to take out loans for anything other than day-to-day transactions. Private equity funds, real estate private equity funds, debt funds, and other types of funds invest in various combinations.

Category 3

Short-term investments are made in these funds, which are then sold as hedge funds to generate short-term profits. Various hedge funds, PIPE funds, and other AIFs fall within this group.

Registration of Alternative Investment Funds: Eligibility

The following requirements must be met in order for AIFs to be registered:

- The ability of an entity to encourage the public to subscribe to its shares is limited by its MOA and AOA.

- At no point shall the total number of investors surpass 1000.

- If an application for AIF registration is a registered trust, a trust deed legally registered under the Registration Act 1908 must also be provided.

- If the applicant is an LLP, a partnership deed must be provided, and the deed must be properly registered under the LLP Act 2008.

- AIF investors must be either resident Indians or non-resident Indians.

- A minimum corpus of 20 crores is required for each AIF.

Entities that are not eligible to register for the AIF

The following entities are not permitted to be registered as AIFs under SEBI guidelines:

- Employee benefits are the primary objectives of a Trustor Gratuity registered.

- Any family trust established with the primary goal of providing advantages to family members.

- The ESOP trust has been registered with the Securities and Exchange Board of India (SEBI).

What is the maximum size of an AIF?

Is it possible for an AIF to raise any amount of money from any investor? An AIF can attract money from any competent investor, including Indians, foreigners, and non-resident Indians, who are willing to take on the risk of investing in predominantly unlisted or illiquid securities.

A minimum capital size of INR 20 crores is required. However, an AIF (other than an angel fund) will not accept an investment of less than one crore rupees from an investor. The minimum investment amount for investors who are employees or directors of the AIF or employees or directors of the Manager is twenty-five lakh rupees.

Registration with the AIF necessitates the submission of certain documents

- Names, addresses, and other information about registered addresses.

- In the event of a corporation, the company's registration certificate is required.

- Name and contact information for the applicant, including phone number, email address, and residential address.

- If the applicant is an LLP, the partnership deed is required.

- If the petitioner is a trust, they must submit a trust deed.

- Business strategies and investment plans are both important.

- The placement memorandum in draught form.

- Directors/partners/members make a self-declaration.

- Previous year's financial statements.

- Whether or not the sponsor or directors are registered with the Board is debatable.

- The sponsors had previously registered AIF.

- Sponsors' previous work history.

AIF registration business plan

The following are the details of the business plan and investment strategy:

- The fund's main goal.

- 2 The fund's investment style and approach.

- The Fund's or Scheme's duration.

- If applicable, the target industries/sectors.

- Corpus that has been proposed.

- Investors who are looking to invest.

- Fee structure for the Sponsor and Manager that has been proposed.

- Any legal action taken against the sponsors or the director.

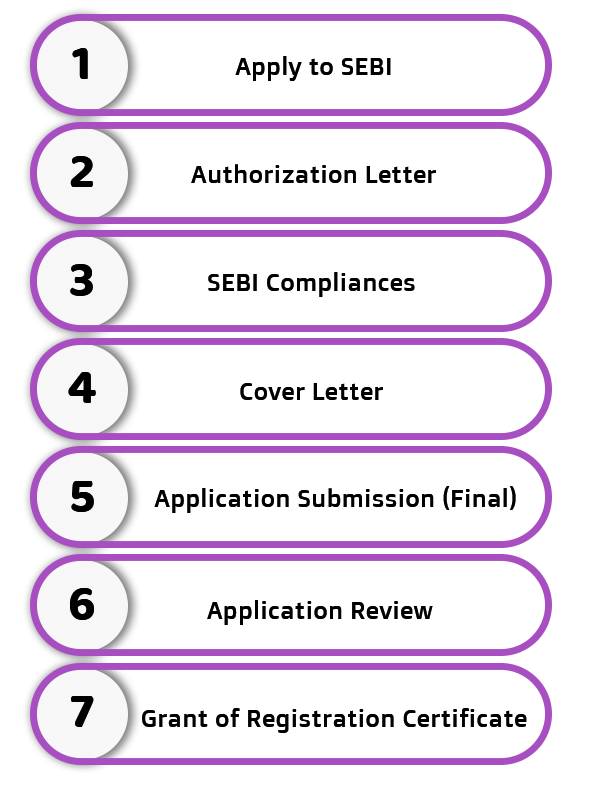

AIF Registration Process

The following is a step-by-step guide to registering an Alternative Investment Fund:

Apply to SEBI

Applicants must submit an application in Form A of the SEBI (Alternative Investment Funds) Regulations, 2012, along with all supporting papers and a business plan.

Authorization Letter

If an applicant or entity has permitted any director, promoter, or other officer to act as an authorized signatory, provide an authorization letter.

SEBI Compliances

To determine whether an applicant is eligible or ineligible to be registered as an AIF, the applicant must properly review the SEBI rules.

Cover Letter

If the applicant is registered with SEBI as a venture capital fund, it must include information about it in the cover letter, as well as whether it has conducted any activities as an AIF or is seeking registration for a new fund.

Application Submission (Final)

On this account, an online application is filed in accordance with SEBI standards. For the grant of a certificate of registration, a properly filled, numbered, duly signed, and stamped Form A must be submitted, along with the necessary documents and an application fee of INR 100000 in the form of a draught drawn in favour of The Securities and Exchange Board of India, payable at Mumbai.

Application Review

Within 21 days of receiving an application, SEBI will review it and respond to the applicant. SEBI evaluates the application for correctness, and if satisfied, approves the application.

Grant of Registration Certificate

SEBI will give the registration certificate after it has been satisfied with the application and the registration fees have been paid.

Fees for AIF registration

For the issue of a Certificate of Registration, an applicant must submit the following registration fee after receiving SEBI approval:

- If the application for AIF registration falls into category I, the fee is INR 500000.

- If the application for AIF registration falls into category II, the fee is INR 100000.

- If the application for AIF registration is of Category-III, the fee is INR 1500000.

This certificate is valid for the duration of AIF's existence, until it is wound up.

Restrictions of AIFs

Fundraising Restrictions For AIFs And Investments

The fundraising of AIFs and the investments made by such AIFs are subject to the following restrictions:

- Private placement is an option for AIFs to raise funds.

- AIFs cannot take investments from investors worth less than INR 1 crore.

- There are a maximum of 1000 investors authorised in this fund, and each scheme's corpus limit is INR 20 crore.

- At least one of the following interests must be maintained by the promoter, sponsors, or manager:

- Invest a minimum of 5 crore or 2.5 percent of the initial corpus. The continuing interest for Category AIF category III must be at least 5% of the corpus or Rs. 10 crores, whichever is lower.

- AIFs registered in Categories I and II are not permitted to invest more than 25% of their investment fund in a single investee firm. The restriction for Category-III AIFs, on the other hand, is 10%.

- Closed-ended AIFs can be listed on the stock exchange for a minimum of INR 1 crore each trading lot after the scheme or fund is closed.

AIFs have a limit on the number of investors/members they can have.

AIF regulations impose the following restrictions on the number of investors or members:

- AIFs (other than Angel Funds) are limited to a maximum of 1000 investors at any given time.

- In the case of Angel Funds, at any given moment, no scheme can have more than 49 investors.

- AIF is permitted to obtain funds through a Private Placement but is not permitted to solicit the general public to subscribe to its shares.

Mechanism for Resolving Complaints

Investors who have objections or grievances against AIFs must address them. SEBI has built a web-based centralised grievance redressal mechanism known as SCORES for this purpose (SEBI Complaint Redressal System).

The issue will be resolved by AIF's manager/sponsor/promoter in the form of arbitration or another method agreed upon by the investors and AIF.

Post Registration Compliances

AIF Must Comply with SEBI's Reporting Norms After It Has Been Registered:

- Quarterly: by I, II, and III categories (not employing leverage).

- by Category-III, on a monthly basis (employing leverage).

- In addition, Category-III AIFs must follow the risk management, compliance, redemption, and other requirements outlined in the circular.

- After hedging offset, leverage for Category-III must not exceed two times the gross exposure.

Other Requirements for Compliance

- The AIF must adhere to the SEBI's reporting requirements.

- If any major changes are made to the information already provided to SEBI at the time of application, AIF will notify SEBI.

- AIF must maintain a close eye on the SEBI website for any new circulars, changes, or instructions that have been issued.

- If the corpus exceeds 500 crores, the AIF must select a custodian to protect the money.

- AIF's books of accounts must be audited by a trained auditor once a year.

- Sponsors and managers must declare any potential conflicts of interest.

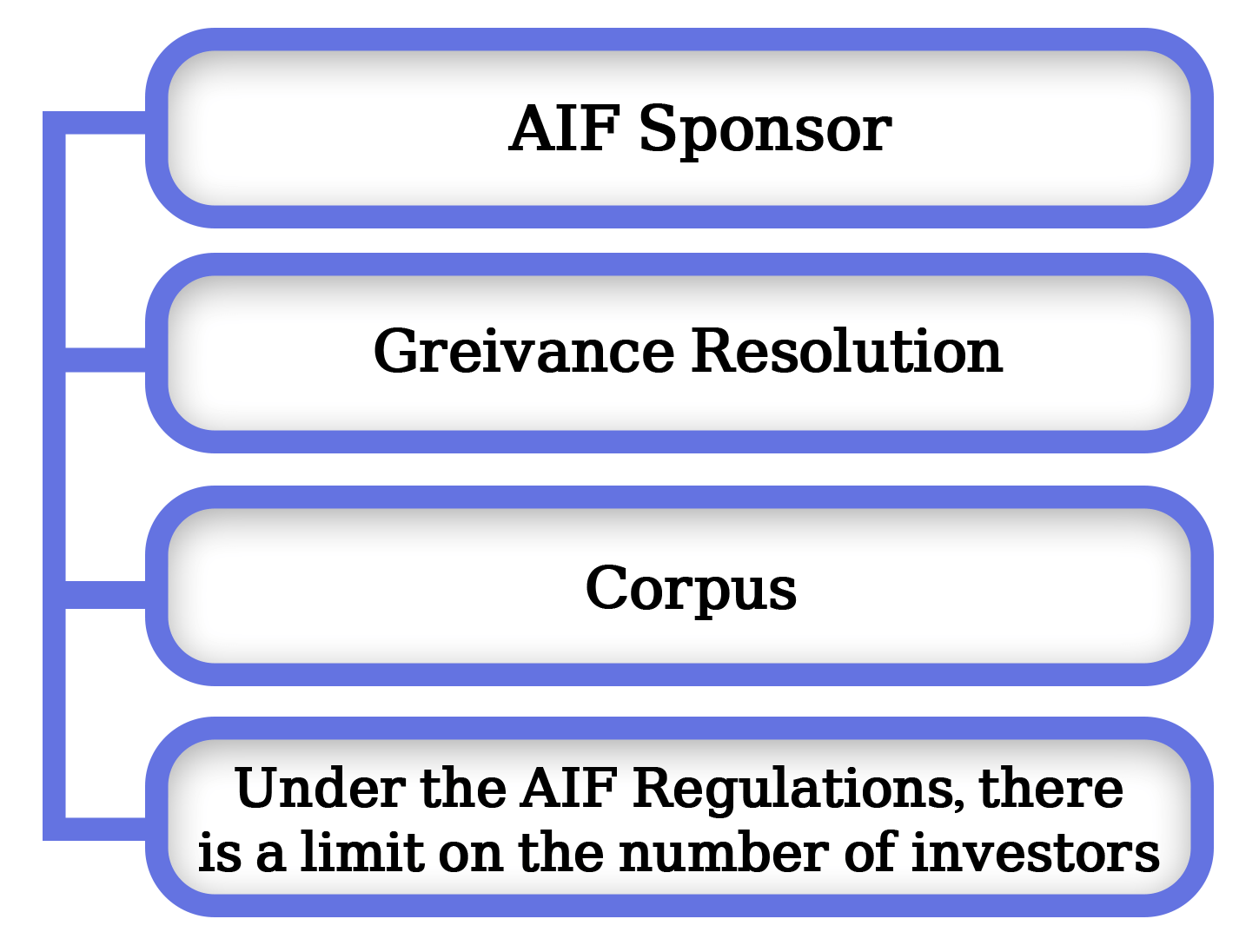

Other Considerations in the Registration of Alternative Investment Funds

AIF Sponsor

The Sponsor of an Alternative Investment Fund is an individual who founded the fund, which might be a promoter in the case of a corporation or a proposed partner in the case of an LLP.

The Alternative Investment Fund Registration Certificate will remain in effect until the AIF is closed. The certificate of an Alternative Investment Fund Registration, on the other hand, would be valid for the rest of one's life.

Corpus

It is the total amount of funds committed to the Alternative Investment Fund by investors on a certain date via a written agreement or other document.

Under the AIF Regulations, there is a limit on the number of investors.

There must be at least 1000 investors in any Alterh3native Investment Fund (other than angel funds). No plan may have more than 49 angel investors in the case of an angel fund. An Alternative Investment Fund, on the other hand, can only raise funds from complicated investors through private placement and cannot issue a general invitation to pledge its units.

Grievance Resolution

Investors can make complaints about Alternative Investment Funds through the Securities and Exchange Board of India's "SEBI Complaint Redress Mechanism (SCORES)," a web-based centralised complaint redress system. For the purpose of resolving disputes, the AIF, Sponsor, or Manager must establish a method for resolving disputes between the investors, Manager, AIF, or Sponsor through arbitration or any other mechanism agreed upon between the AIF and the investors.

Why Choose Us

Free Legal Advice

Transparent Pricing

On Time Delivery

Expert Team

Money Back Guarantee

200+ CA/CS Assisted

Lowest Fees

Easy EMIs

Frequently Asked Questions

Any fund registered or founded in India, a privately pooled investment vehicle that aggregates investors' funds, whether they are Indian, Non-Resident Indian, or foreign, is referred to as an AIF.

It is a sub-category of VCF, or Venture Capital Fund, that falls under Category I of AIF and seeks assets from angel investors and invests in accordance with Chapter III-A of the Alternative Investment Fund laws.

9559179325

9559179325 9559179325

9559179325 9559179325

9559179325