Overview of Liaison Office Registration

A liaison office, also known as a representative office, serves as a communication link between a parent firm based in another country and its Indian affiliates. Foreign corporations establish liaison offices in India to explore and support business opportunities in the country.

This type of office serves as a communication hub. It promotes import and export from and to India, as well as foreign parent/group business technical and financial engagement, market research, and feedback.

Liaison offices provide a valuable opportunity for foreign investors. It enables overseas investors to research the Indian industry and develop a fast-growing market while limiting their financial, legal, and administrative obligations.

Activities of the Liaison Office in India that are permitted

- Establish open lines of contact between the foreign head company and the Indian stakeholders with the goal of expanding market potential.

- Import/export relationships between countries are encouraged.

- Form a financial and technical partnership between Indian and international businesses.

- Represent the parent company's overseas subsidiary in India.

Many multinational corporations are prepared to invest in the Indian market because it is one of the world's fastest developing and rising economies. As a result, they are constantly looking forward to opening a liaison office in India.

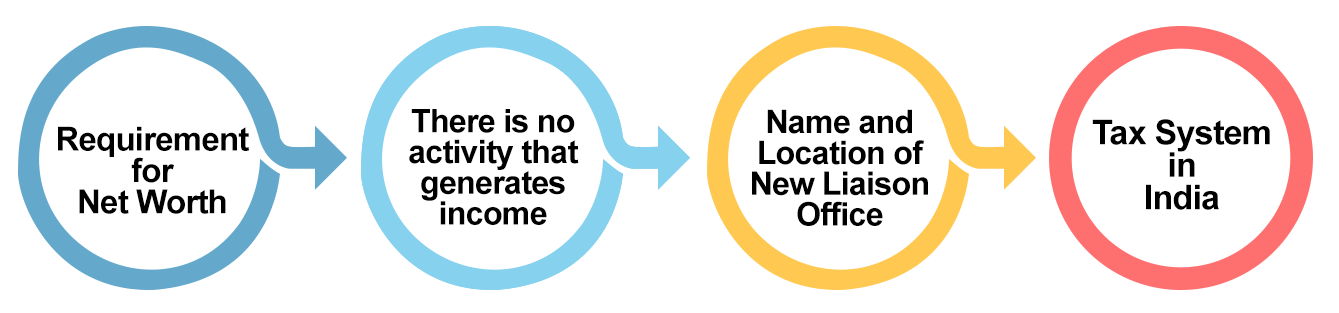

Things to consider before Registering Liaison Office

Before registering a liaison office in India, there are a few things to think about.

Requirement for Net Worth

A parent firm must have a positive track record for the previous three years, as well as a net worth of $50,000 as attested by its auditors.

There is no activity that generates income.

Because the liaison office is not permitted to produce any income in India, the parent firm funds all of the liaison office's operations.

Name and Location of New Liaison Office

The name must be comparable to the parent company's name in another country. In addition, each new liaison office requires a new approval from the Reserve Bank of India, which must be justified in detail.

Tax system in India

A liaison office has the right to be taxed by the income tax authorities.

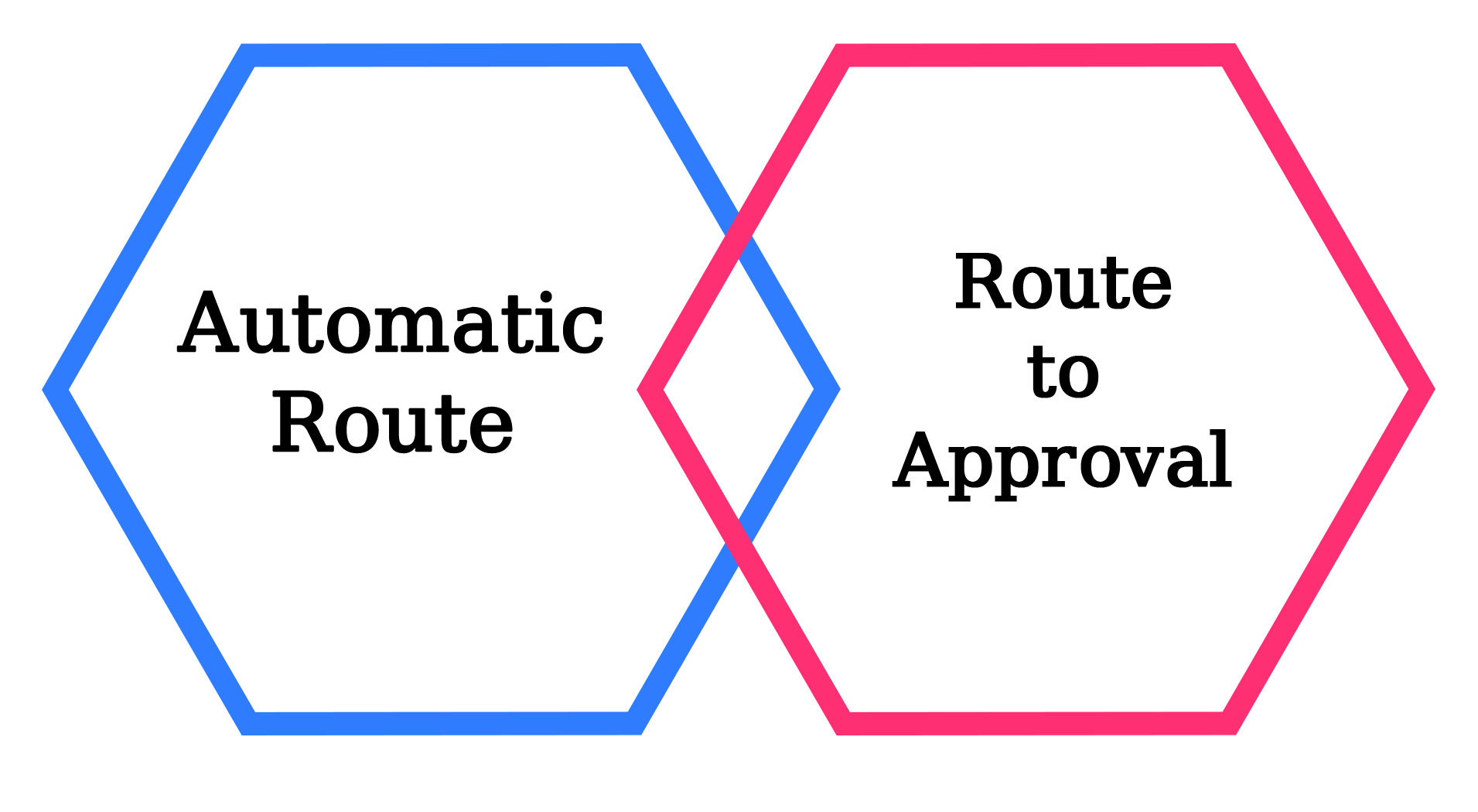

Route for RBI Approval

Automatic Route

The prospective entity applicants do not need previous approval from the RBI or the Indian government under the automated method. So, these are the industries in which 100 percent FDI is permitted. Furthermore, such candidates are citizens of nations with which India has no geographical borders.Route to Approval

In the following situations, the approval route is used.

- The applicant company is based in Pakistan, China, Sri Lanka, Iran, Afghanistan, Bangladesh, Hong Kong, or Macau, and the application is for the establishment of a BO/LO/PO in Jammu and Kashmir, Andaman & Nicobar Islands, and the North East region.

- The four main commercial areas are private security, telecommunications, defense and information, and broadcasting.

- The petitioner is a non-governmental organization (NGO).

Documents Required for Liaison Office Registration

List of Documents Required by the Parent Company for Liaison Office Registration

- Certificate of Foreign Company Incorporation/Registration

- Certificate of Foreign Company Incorporation/Registration

- Memorandum of Association

- Articles of incorporation.

- Directors' complete information.

- Complete list of the applicant company's shareholders.

- Certified Public Accountant's attestation of net worth (CPA).

- Financial statements for the previous three years that have been audited.

- Banker's report on the applicant.

The Proposed Authorized Signatory Must Provide the Following Documents

- 5 photographs the size of a passport

- 5 passport copies are required.

- Arrival stamp from immigration on a business visa.

- 5 copies of the national ID card

- Proof of address (bank statement, electric bill, water bill, or phone bill).

- While appointing the AR, the board passed a resolution.

- In the name of AR, a power of attorney is granted.

India's Liaison Office Registration Eligibility Criteria

The Foreign Exchange Management Regulations of 2016 govern the establishment of a foreign company's place of operation. In order to open a liaison office in India, it is necessary to meet the following criteria:

- It is forbidden to engage in any activity that generates income.

- The foreign headquarters must have a net value of more than $50,000.

- The applicant company must have a positive track record over the last three years.

Forms and Documents for the Government

Following receipt of the complete set of documents, the applicant company and the authorized signatory must draught the following documents for signature purposes.

- Resolution of the Board of Directors approving the establishment of a liaison office in India.

- A statement from the applicant regarding FDI eligibility and funding source.

- A declaration describing the nature of the proposed Liaison office's operation and its location.

- A statement describing the type of the applicant's business and the location of its operations.

- Fill out the FNC form.

- The controlling company's letter of assurance.

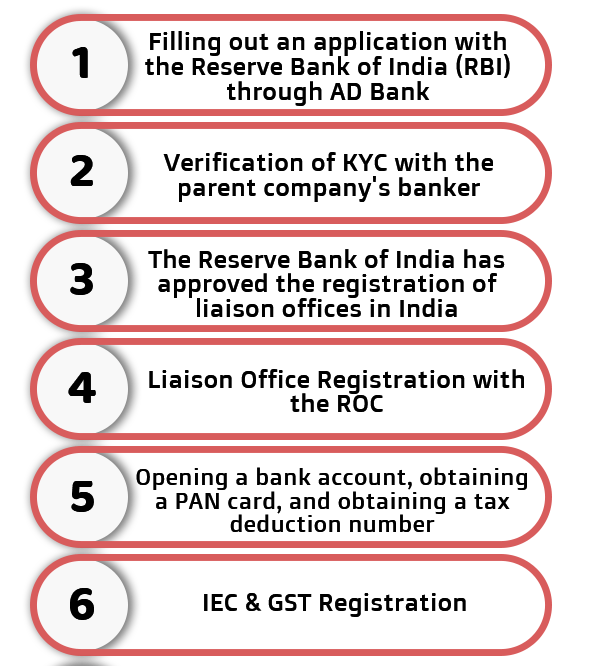

Liaison Office Registration Process in India

Filling out an application with the Reserve Bank of India (RBI) through AD Bank

The FNC receives an application for a liaison office from a foreign corporation. The Reserve Bank of India receives the application through AD Bank (Authorized Dealer). The AD bank is vital since it is through them that all communication with the RBI is routed.

Verification of KYC with the parent company's banker

A request for document examination is sent to the foreign firm's banker. Swift-based verification refers to the procedure of submitting requests for verification. The application is sent to the RBI for clearance once the foreign lender has verified the papers. Depending on the circumstances, the RBI may also request additional paperwork.

The Reserve Bank of India has approved the registration of liaison offices in India.

The AD Banker follows a specific policy when it comes to approving the liaison office in India. The scenarios when the automatic route is not available are given priority.

Liaison Office Registration with the ROC

The company's bank account is opened after it is formed, and the FDI must be received within 180 days of the company's formation, with an early announcement to the banker.

Opening a bank account, obtaining a PAN card, and obtaining a tax deduction number

PAN numbers are issued by India's income tax agency and are unique 10-digit numbers. The liaison office can open a bank account once it has received its PAN number. To comply with all TDS rules, every taxpayer must get a Tax Deduction Account Number.

IEC & GST Registration

When you get a bank account and a chequebook, you'll need a copy of the check to register for GST registration and an Import Export Code.

Why Choose Us

Free Legal Advice

Transparent Pricing

On Time Delivery

Expert Team

Money Back Guarantee

200+ CA/CS Assisted

Lowest Fees

Easy EMIs

Frequently Asked Questions

A liaison office is a representative office of a parent corporation that is based in another country. Working in business communication, encouraging import and export from/to India, boosting technical and financial participation of foreign parents/group companies, doing market research, providing feedback, and so on are all things that a liaison office can do.

In India, a Liaison Office of a distant mother organization is not considered as a distinct and distinct entity.The Indian government applies higher rates to the benefits of such elements for all duty reasons. A distant organisation is subject to a 40% income tax.

9559179325

9559179325 9559179325

9559179325 9559179325

9559179325