Limited Liability Partnership

Incorporate world Limited Liability Partnership has a very significant role. Limited Liability Partnership Registration is mandatory as per the law. It is governed by the LLP Act, 2008. Generally, a layman thinks that both the LLP and general partnership are the same and the same limitations and liabilities apply to both of them, but it is a myth because both are very different. In the modern era, it is preferred because it is an autonomous body and its liabilities are separate from its partners. It has many more advantages which make it best in the corporate world. The concept of LLP came to India in the year 2008. Since then it has been preferred by several embryonic entrepreneurs, Financial Advisory Consultancies, Business Consultancies, Law Firms, Real Estate Agencies, Auditing Firms, Real Estate Agencies, Small and Medium-sized Businesses, etc. Further, the main reason for obtaining Limited Liability Partnership Registration is that it protects the personal assets in the case of a dispute and provides various tax benefits as well. The Limited Liability Partnership Registration process and other related things will be discussed below in detail which can help you to know it well.

What is a Limited Liability Partnership?

As per Section 1(n) of the LLP Act, 2008 any partnership formed under the mentioned act of 2008 will be considered a Limited Liability Partnership. A Limited Liability Partnership is a body corporate formed and incorporated under LLP Act, 2008. It is a legal entity separate from that of its partners. It shall have perpetual succession. Any change in the partners of a Limited Liability Partnership shall not affect the existence, rights, or liabilities of the Limited Liability Partnership.

What is a Limited Liability Partnership Agreement?

As per Section 2(m) of the LLP Act, 2008 Limited Liability Partnership Agreement means any written agreement between the partners of the Limited Liability Partnership or between the Limited Liability Partnership which determines the mutual rights and duties of the partners and their rights and duties in relation to that Limited Liability Partnership. Further, this model is the blend of the benefits given to a private limited company and a conventional partnership firm.

Difference between LLP and Partnership Firm

These two concepts often confuse the people, but after reading the pointers given below your confusion will be vanished forever. Read the following points very carefully to determine the difference between LLP and Partnerships Firm-

- In a General Partnership Firm maximum number of partners can be limited to 10 whereas there is no such limitation on the LLP.

- General Partnership Firm doesn’t have separate legal status while LLP possesses separate legal status.

- Liability of partners in a partnership firm is unlimited on the other hand in LLP’s liability of the partners is limited to a certain extent.

- Shares in LLP can be transferred more easily in comparison to General Partnership Firm.

- LLPs have perpetual succession but in General Partnership Firms this concept is missing.

- LLP can do things in its own name while partnership firms cannot do that.

- LLP must have to file annual returns whereas partnership firms need not do that.

- General Partnership Firms are governed by the Partnership Act, 1932 while LLPs are governed by the LLP Act, 2008.

- General Partnership Firm’s accounts can be managed easily in comparison to LLP.

- LLPs are easy to manage in comparison with partnership firms.

- LLPs are dissolved through NCLT while partnership firms can be dissolved only by the consent of the partners of the firm.

Which is better to choose LLP or General Partnership Firm?

With the above-mentioned differences between LLP and General Partnership Firm, it is pertinent to say that LLPs are better than General Partnership Firms. Hence it is always better to choose LLP over General Partnership Firms.

Features of Limited Liability Partnership Firm

Features of the LLPs are given below-

- There is no maximum limit on the number of partners in LLPs.

- LLPs have their own legal status.

- They are personally liable for their actions as their partners have limited liability.

- Their transferability is easy as compared to the other business models.

- LLPs have perpetual succession.

- LLPs can purchase movable or immovable properties by their own names.

- LLPs have less compliance as compared to other business models.

- They are easily manageable.

- Dissolution is through NCLT.

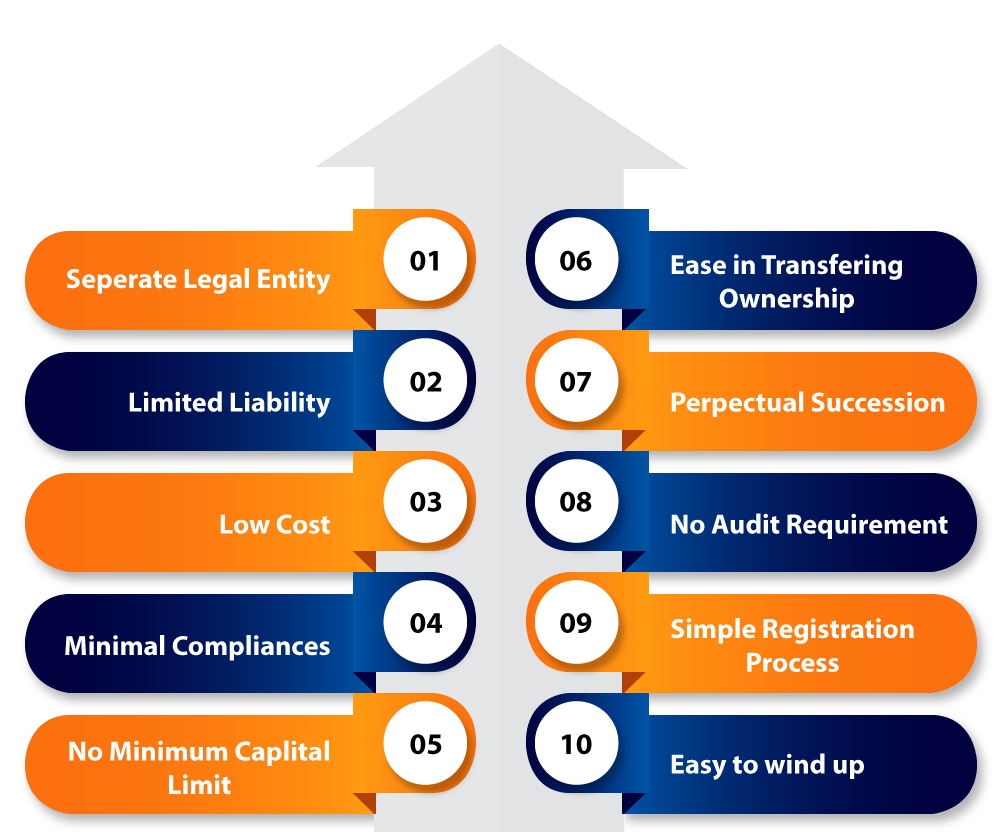

What are the main benefits of the LLP?

Limited Liability Partnership gives various advantages some of the important one is discussed below-

Separate Legal Entity

Limited Liability Partnership has its own separate legal identity just like the companies. Such entities have various rights; one of them is the Right to Sue. All the formalities like signing contracts are done by the name of LLP itself. It completely holds a separate identity from its partners.

Limited Liability

Limited Liability Partnership’s partners have limited liability. They are liable to a certain extent only. It has been said that in case of insolvency only the LLP will be liable. Its assets will be used against the debt. Partners will not be personally liable for the debt.

Low Cost

In comparison with other business structures like a private limited company or public limited company, a Limited Liability Partnership has a low cost, in its formation. Its low-cost factor makes it preferable among the people.

Minimal Compliances

In comparison with other business structures like a private limited company or public limited company, a Limited Liability Partnership has minimal compliances. It is one of the many reasons; it is highly preferable among the people.

No Minimum Capital Limit

This business structure can be formed without any minimum capital because for this kind of business structure there is no limit set.

Ease in Transferring Ownership

Unlike a Private Company, the partners of an LLP Firm can easily transfer their ownership to others. There are fewer formalities and easy rules regarding the same.

Perpetual Succession

The term Perpetual Succession denotes that the entry and exit of members will not affect the continuance of the LLP Firm; its working will remain the same.

No Audit Requirement

There is no need of maintaining books of accounts except in certain conditions which are when the annual turnover exceeds the threshold limit of Rs 40 lakhs; or if the capital contribution exceeds the limit of Rs 25 lakhs.

Simple Registration Process

Nowadays, the procedure for obtaining registration is a very difficult task but when it comes to Limited Liability Partnership Registration it is completely the opposite. It is easy to get Limited Liability Partnership Registration.

Easy to Wind up

Limited Liability Partnership is not only easy to incorporate but easy to wind up as well, unlike a private limited company or public limited company. It is also a reason for its popularity among the people.

Pre-requisites of LLP Registration

- Filing of an LLP Agreement;

- Apply for TAN (Tax Deduction Account Number);

- Apply for PAN (Permanent Account Number);

- Open a Bank Account;

Annual Compliances for LLP Firm

- Statement of Account and Solvency;

- Filing of LLP Annual Return;

- Filing of Income Tax Return;

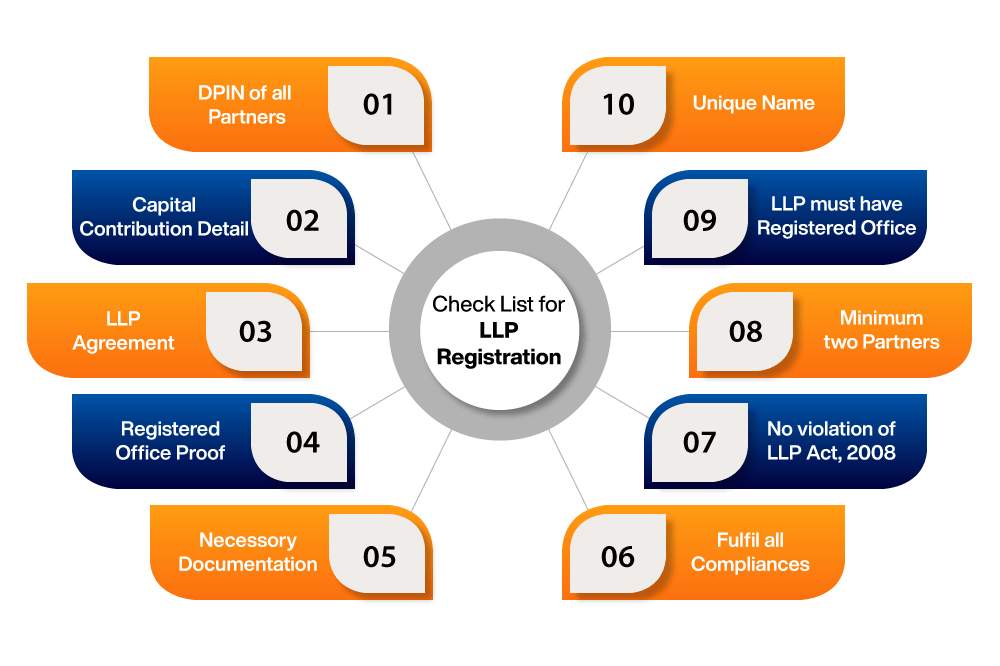

Minimum Requirements of the Limited Liability Partnership Registration

There is much compliance that one needs to be followed while taking Limited Liability Partnership Registration. Some of the important ones are given below-

- Any individual or corporate body can be a partner in a Limited Liability Partnership.

- Every Limited Liability Partnership shall have at least two partners as per the LLP Act, 2008.

- Every Limited Liability Partnership shall have at least two designated partners and at least one of them shall be a resident in India.

- Every LLP shall have a registered office to which all communications and notices may be addressed and where they shall be received by the appropriate authority.

- Every Limited Liability Partnership shall have either the words "limited liability partnership" or the acronym "LLP" as the last words of its name.

- Name should be unique and not identical to any other Limited Liability Partnership in the market.

- Every Limited Liability Partnership shall ensure that its invoices, official correspondence, and publications bear the name, address of its registered office and registration number of the LLP, and a statement that it is registered with limited liability.

- Every partner shall inform the LLP of any change in his name or address within a period of fifteen days of such change as per the law.

- Every Limited Liability Partnership shall file an annual return duly authenticated with the Registrar within sixty days of closure of its financial year.

Check List for Limited Liability Partnership Registration

Legal Documents Required for the Limited Liability Partnership Registration

Following are the important documents regarding the Limited Liability Partnership Registration-

The documents required for the Limited Liability Partnership Registration are as follows:

- PAN Card, Aadhar Card, Driving License, Voter ID of the Partners;

- Address Proof of the Partners;

- Residence Proof of Partners;

- Latest Photograph;

- Passport (if in case any of the partners is a Foreign National or an NRI);

The documents required for Limited Liability Partnership are as follows:

- Address Proof of the Registered Office;

- Digital Signature Certificate;

- No-Objection Certificate from the Landlord whose premise has been used as the Registered Office;

- Utility Bill in the form of Water Tax Receipt, Electricity Bill (not older than two months)

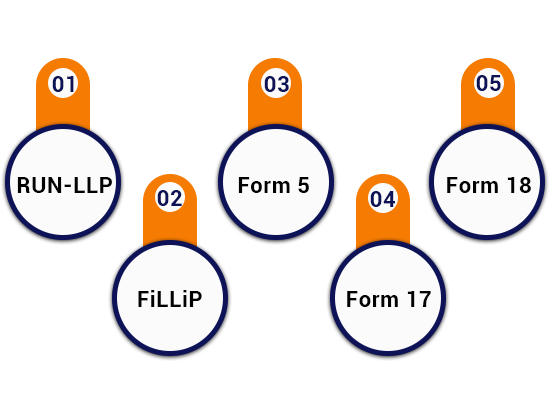

Different types of Forms required for LLP Registration

forms-for-llp-registration.png RUN-LLP is required for the reservation of the name of the LLP for which one wants to register him or herself. FiLLiP is the second form that is required for incorporating LLP Firms in the market. If one wants to change the name of the LLP then he or she has to give a notice for the change of name with the help of Form-5. Form-17 is the application form required for the conversion of a Partnership Firm into a Limited Liability Partnership Firm. The last one is Form 18 which is the application form required for the conversion of a Public Ltd Company into a Limited Liability Partnership Firm.

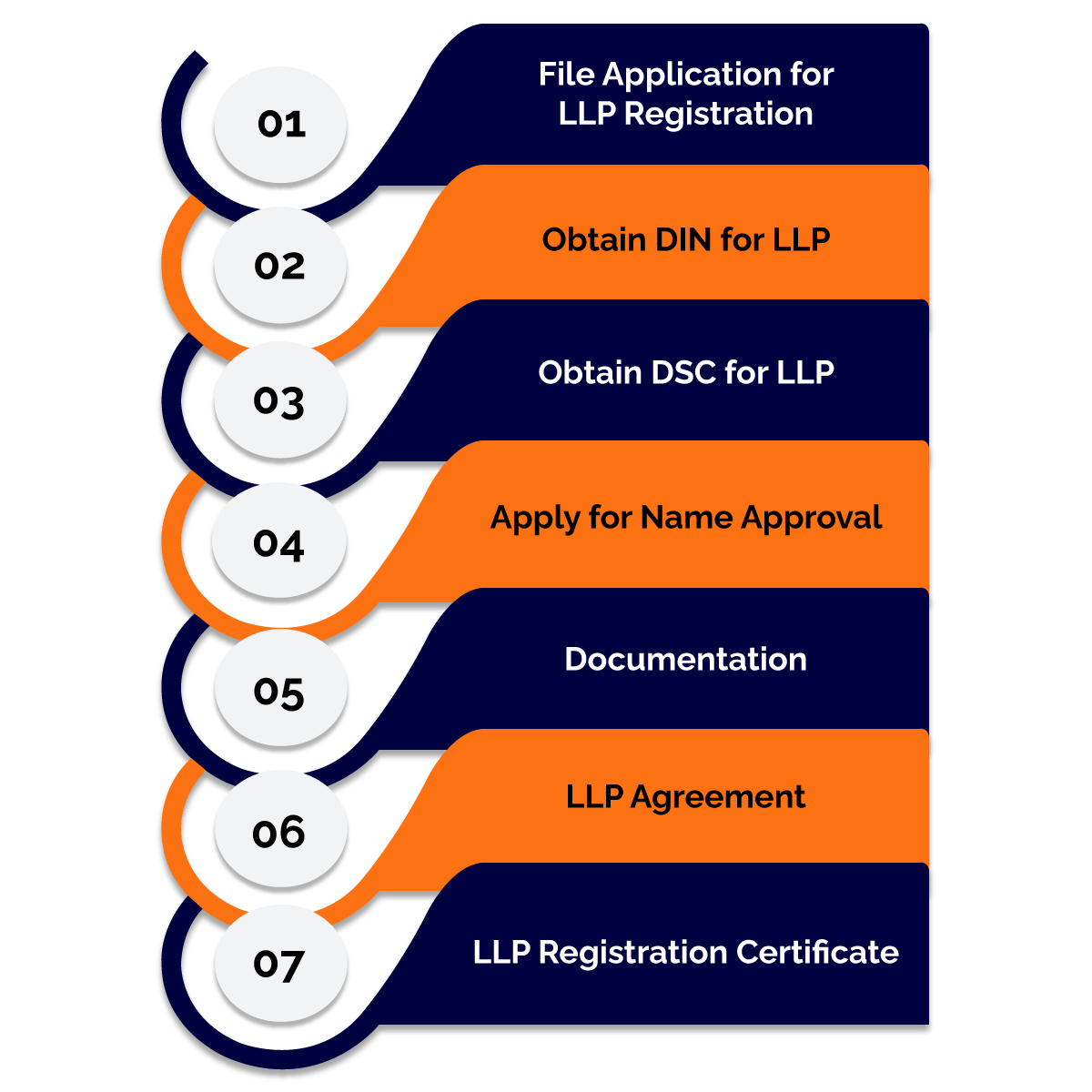

Procedure to obtain Limited Liability Partnership Registration

Follow the steps given below to get the LLP Registration-

- In the first step, the proposed partners of an LLP Firm need to fill out an online application for the registration of the LLP.

- Now, it is compulsory for all the partners to have DIN (Director Identification Number) and DSC (Digital Signature Certificate) for at least one proposed partner. Hence you need to obtain a DIN and DSC Number for the fulfillment of the second step of the registration procedure.

- After the above process, the partners need to apply for reserving a unique name for the firm with the MCA. Further, the name reserved remains valid for the period of 90 days starting from the date of reservation. Also, partners can suggest a maximum of two names to the ROC by way of filling RUN.

- After the successful name approval, all the proposed designated partners need to submit the documents required for LLP Registration, such as Latest Photograph, Aadhar Card, PAN Card, Address Proof, etc.

- Now, the partners need to draft an LLP Agreement containing all the roles, responsibilities, and duties of the designated partners concerned. Further, it shall be significant to state that the partners need to file this LLP Agreement within 30 days in Form 3 either at the official MCA portal or to the respective ROC.

- Lastly, the partners need to apply for the Certificate of Registration (COR) of LLP, together with the Limited Liability Partnership Identification Number.

Why you should choose Bizadvisors?

BizAdvisors is one of the platforms that work together to meet all of your legal and financial needs while also connecting you with dependable specialists. Yes, our clients are happy with the legal services we provide. They have continually regarded us well and provided regular updates because of our focus on minimizing legal requirements. Our clients can also keep track of the progress on our platform at any moment. Our knowledgeable professionals are here to answer any queries you may have concerning the Limited Liability Partnership Registration process. BizAdvisors will make sure that your interactions with professionals are pleasant and smooth. Following are the reasons one should choose Bizadvisors-

- BizAdvisors is one of the many platforms which coordinate to fulfill all your legal requirements.

- It connects you with a team of expert professionals who can help you in every possible way.

- Its focus is on simplifying the legal requirements for the client.

- If you have any questions regarding LLP we are just one phone call away.

- We have a very dedicated team that is ready to help you and guide you.

- We give you reliability and trust.

- We make sure that we will provide you with the best services and can satisfy you with our quality work.

Conclusion

In the modern time when every third person wants to start their own business, LLP is the best business model to choose. It mandatorily needs a Limited Liability Partnership Registration. LLPs are governed by the LLP Act, 2008. It is easy to maintain and its compliances are also not tough to fulfill, hence it is the best option for anyone. In comparison to General Partnership, LLP is always better to choose.

Frequently Asked Questions

As per the Section 1(n) of the LLP Act, 2008 any partnership formed under the mentioned act of 2008 will be considered as the Limited Liability Partnership.

As per Section 2(m) of the LLP Act, 2008 Limited Liability Partnership Agreement means any written agreement between the partners of the Limited Liability Partnership or between the Limited Liability Partnership which determines the mutual rights and duties of the partners and their rights and duties in relation to that Limited Liability Partnership.

Post-requisites of LLP Registration are given below-

- Filing of an LLP Agreement;

- Apply for TAN (Tax Deduction Account Number);

- Apply for PAN (Permanent Account Number);

- Open a Bank Account

Following are the Annual Compliances of the LLP-

- Statement of Account and Solvency;

- Filing of LLP Annual Return;

- Filing of Income Tax Return;

9559179325

9559179325 9559179325

9559179325 9559179325

9559179325