Overview of Insurance Broker License

An insurance broker licence is granted to a knowledgeable and competent individual or firm working through its directors, partners, or employees who are familiar with insurance regulations and have appropriate knowledge of insurance products. They make people aware of their insurance requirements. An insurance broker assists customers with a variety of services and operates as a liaison between an insurance agency and a person interested in purchasing an insurance policy.

Nowadays, the market offers a large range of insurance products, which can make it difficult for a layperson to make the best insurance decision. An Insurance Broker advises clients on the finest options for their needs and assists them in making sound financial decisions. Between the general public and insurance firms, an Insurance Broker serves as a go-between. They help consumers choose the best insurance plans for their specific financial needs. A corporation must get an Insurance Broker License before it may begin any insurance brokerage-related activity.

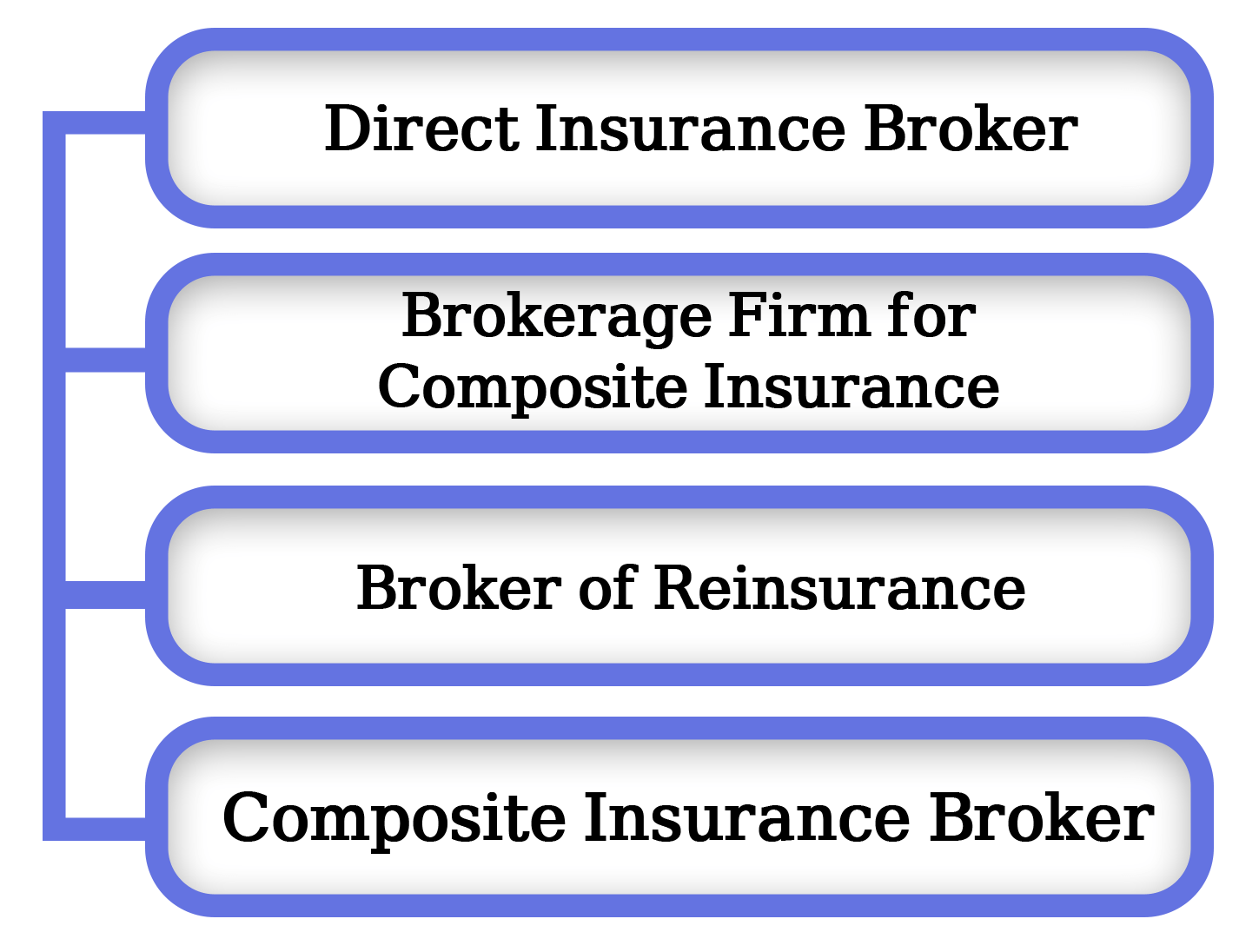

Types of Insurance Broker License

Furthermore, there are three types of insurance brokers.

Direct Insurance Broker

Sales and Acquisition of Insurance Business allows a consumer to purchase an insurance policy through its website or software and receive a commission from the insurance agency that sold the policy. Direct Insurance Brokers provide information on the numerous insurance products and insurance companies on the market. They assist clients in selecting the best insurance for their specific needs. A direct insurance broker’s responsibility can include setting an e-insurance account for a client and assisting them in paying their premiums to their insurers.

Brokerage firm for Composite Insurance

In exchange for compensation or fees, it is a type of Insurance Broker License that requests and organises insurance or perhaps reinsurance for its customers with safety net providers and reinsurers located in India or potentially outside. A Reinsurance Broker works in the same way as a Direct Insurance Broker. The following are the responsibilities of a reinsurance insurance broker:

- Business statistics for the reinsurance market are kept up to date.

- Reinsurance-related products are sold.

- Negotiating on behalf of the client

Broker of Reinsurance

In exchange for compensation or fees, it is a type of insurance Broker License that asks and designs insurance for its customers with backup plans and reinsurers located in India or potentially elsewhere.

Composite Insurance Broker

A Composite Insurance Broker's insurance services are primarily connected to general and life insurance. The IRDAI, on the other hand, is quite selective in who it licences as a Composite Insurance Broker.

Insurance Broker License Regulatory Framework

The following are the legal provisions that govern the Insurance Broker License in India:

- The Insurance Regulatory Development Authority Act of 1999 is a federal law that regulates the insurance industry.

- Insurance Brokers Regulations of the Insurance Regulatory Development Authority of India, 2018.

What is the meaning of an insurance broker's licence?

The Insurance Regulatory and Development Authority oversees and regulates the insurance broker licence (IRDA). Insurance Broker License functions and operations are also managed by IRDA.

An Insurance Broker is a person or a corporation that is registered with the Insurance Regulatory and Development Authority (IRDA) that provides insurance advice. It aids the customer in obtaining insurance coverage from an insurer. An insurance broker is a skilled, knowledgeable, and experienced individual who works to give insurance coverage. An insurance broker serves as a link between the insurance company and the customers who are looking to buy an insurance policy. Insurance Broker License should fall into one of the following categories, according to these guidelines:

- Direct Insurance Broker License - Rs 75 Lac in capital is necessary.

- A composite insurance broker licence is necessary, with a capital requirement of Rs 5 crore.

- License as a reinsurance broker is necessary, with a capital requirement of Rs. 4 crores.

Who is eligible to apply for a licence as an insurance broker?

In India, the following people are eligible to apply for an insurance broker licence:

- Any business entity that is registered under the Companies Act of 2013.

- Any co-operative society that has been registered under the Co-operative Societies Act of 1912 or a similar statute.

- Any Limited Liability Partnership (LLP) that is registered under the Limited Liability Partnership Act of 2008.

- Any other person who has been approved by the Authority.

If the Insurance Broker License applicant is a registered limited liability partnership, none of the following can be a partner.

- Non Resident Entity

- Any foreign limited liability partnership (LLP) that is registered under the laws of a foreign country.

- Anyone who lives outside of India.

Functions of an Insurance Broker's License

Direct Broker's Functions

- Obtaining thorough information about the client's business and risk management approach.

- Getting to know the nature of the client's business and underwriting information, which can aid you in presenting business issues to insurers and others.

- Making recommendations for appropriate insurance coverage and terms.

- Knowing everything there is to know about the various insurance markets.

- Insurer provides a quote based on the client's requirements.

Re-Insurance Broker's Roles

- Getting to know the client's business and risk retention plan.

- Maintaining accurate and up-to-date records of the insurer's operations.

- Providing guidance on insurance coverage and the various types of insurance coverage available on the worldwide insurance and reinsurance markets.

- Creating a database of available reinsurance markets that includes individual reinsurer solvency ratings.

- Delivering risk management services to protect reinsurance.

- Offering the services of a reinsurer or a group of reinsurers.

Composite Broker Functions

- Negotiating with a reinsurer on behalf of a client;

- All of the functions that are done by Direct Broker and Re-insurance Broker are handled by Composite Broker.

Documents Needed to Obtain an Insurance Broker's License

To receive an Insurance Broker License, you must submit all of the required paperwork and information.

The following documents must be submitted with the information stated in Form C of Schedule I of the IRDA (Insurance Broker) Regulations, 2018 by an applicant:

- The completion of Form B is required in order to submit an application for an Insurance Broker License.

- A copy of the MOA and the AOA.

- In Form G of Schedule I, data identifying the Principal Officer and whether they meet the fit and legitimate measures must be entered. Furthermore, check that all relevant preparation requirements are met before submitting the application.

- A written statement from the Principle official stating that they, along with directors/accomplices and other important administrative personnel, are not subject to any of the Act's exclusions.

- Directors/accomplices, advertising, and other key administrative personnel's peculiarities.

- At least two qualified agents should be listed, along with their qualifications. This is significant since after enlistment, they will be responsible for all insurance requests and acquisitions.

- Account details in its entirety

- Principal bankers' subtleties, as well as statutory advisors.

Procedure for Obtaining an Insurance Broker License

- The candidate with the authorization must submit an adequately filed Insurance Broker License application in Form B found in Schedule I of the rules, along with the non-refundable application fee and required papers.

- If the Authority has any questions after reviewing the application for an Insurance Broker License, it may contact the candidate for more information, documents, or even direct them to consent to any requirements.

- The candidate must submit the requested data, report, or explanation within 30 days of receiving the correspondence.

- If, following careful consideration of the application for an Insurance Broker License, the candidate meets all of the aforementioned requirements, the Authority will provide an in-principle permission for Insurance Broker Registration.

- After receiving basic approval, the candidate must agree to the additional requirements and submit Insurance Broker License fees to the Authority, either in person or online.

- If the Authority is satisfied that the candidate has met all of the requirements set forth in the Act, guidelines, rules, fliers, and other documents, as well as the conditions set forth in the on a basic level approval declaration, it will issue a Certificate of Registration in Form J, as recommended in plan 1.

Insurance Broker License Checklist

The following are the requirements that an applicant company must meet in order to receive an Insurance Broker License:

- The applicant's business name must include the word "broking" at the end.

- The applicant's MOA (Memorandum of Association) must state that the applicant's primary goal is to engage in insurance broking.

- The applicant's company must meet the regulations' minimum financial, capital, and deposit requirements.

- The insurance brokerage firm should not have any foreign investments worth more than 26% of its total paid-up capital.

- The business must deposit 20% of its starting capital with a registered bank.

- The senior officer must have a reasonable qualification, have passed the brokers' exam, and have completed the necessary training.

- A minimum of two people with the required qualifications and training must be hired by the application company.

- To establish an insurance brokerage business, the company needs have the necessary infrastructure as well as well-trained workers.

- The senior officer must have a reasonable qualification, have passed the brokers' exam, and have completed the necessary training.

- A minimum of two people with the required qualifications and training must be hired by the application company.

- To establish an insurance brokerage business, the company needs have the necessary infrastructure as well as well-trained workers.

Insurance Broker License Fee

The fee for an Insurance Broker License must be submitted in Form D of Schedule I by the applicant company. The fees for application, registration, and renewal can be summarized as follows:

Non-refundable application fees:

- 25000 for direct brokers.

- 50000 for a reinsurance broker.

- Rs 75000 for Composite Broker.

For a New Application

- The registration fee is Rs 50000 for a direct broker.

- Rs 150000 for a reinsurance broker.

- Rs 250000 for Composite Broker.

The renewal fee for a period of three years

- 1 lakh for direct brokers.

- 3 lakhs for reinsurance broker

- sum of 5 lakhs for composite broker.

Insurance Broker License Validity and Renewal

Starting from the date of issuance, the certificate of registration for an insurance broker business is valid for three years. Furthermore, at least one month before the validity period expires, the applicant company can make an application for renewal of the insurance broker licence.

Why Choose Us

Free Legal Advice

Transparent Pricing

On Time Delivery

Expert Team

Money Back Guarantee

200+ CA/CS Assisted

Lowest Fees

Easy EMIs

Frequently Asked Questions

In India, there are three main categories of insurance broker licences.

A Direct Insurance Broker License in India has a minimum capital requirement of Rs 75 lakhs.

The key difference between the two is that the former provides data and allows for comparison of various insurance policies accessible in India.

The latter, on the other hand, assists insurance purchasers in selecting the finest insurance plan available based on their financial and coverage needs.

9559179325

9559179325 9559179325

9559179325 9559179325

9559179325