Overview of Prepaid Wallet License

PPIs, or Prepaid Payment Instruments, are instruments that store large amounts of money and can be used to buy products and services by transferring the funds. The amount that the holder actually needs to pay is the pecuniary value contained in the Prepaid Payment Instruments, which can be paid in cash, by credit card, or by debit to a bank account. It should also be highlighted that obtaining a Prepaid Wallet License from the RBI is required in order to launch a Prepaid Payment Instrument. Payment Wallet License is another name for the same thing.

Prepaid Payment Instruments have grown in popularity in recent years as a handy alternative to cash transactions. E-wallets is another name for Payment Instruments. Paytm is one of the most well-known Prepaid Payment Instruments. The Payment Wallet License has a number of important advantages, including increased openness, ease of use, and accountability.

It should also be highlighted that the Reserve Bank of India is now pursuing a number of measures aimed at promoting faster money transfers. The primary purpose of a Prepaid Wallet License is to allow consumers to purchase things or conduct transactions via a digital platform.

However, it should be noted that any firm or business entity interested in obtaining a Prepaid Wallet License must adhere to the Apex Bank's laws, regulations, and guidelines.

Furthermore, the following are the many types of Payment Wallet License:

Mobile Accounts; Smart Cards; Magnetic Strip Cards; Debit Card; Credit Card; Paper Vouchers; Mobile Accounts; Smart Cards; Magnetic Strip Cards;

Prepaid Wallet License Benefits

The following are the advantages of the Prepaid Wallet License:

- It is one of the most convenient and secure methods of transferring money.

- Payment Wallet Instruments are time-saving in that they allow you to pay your electricity bills, mobile phone bills, and other bills from anywhere and at any time.

- Allows you to make a transaction from anywhere.

- Allows for greater transparency and accountability for E-wallet users.

- There are no additional costs or activation fees associated with this application.

- Users can earn rewards, cashbacks, and incentives.

Payment Wallet License Minimum Requirements

The following are the minimal requirements for a Payment Wallet License:

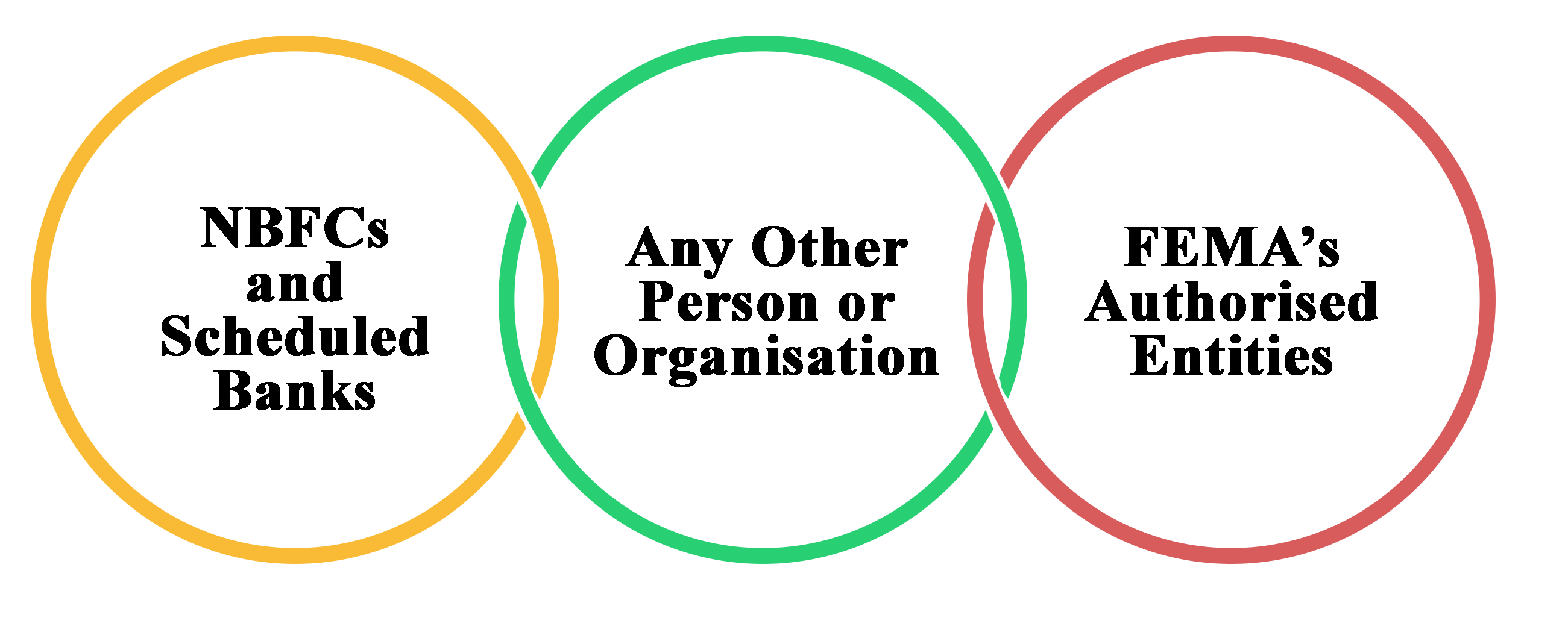

NBFCs and Scheduled Banks

It should be noted that the RBI has not set a minimum capital requirement for Schedule Banks or NBFCs seeking a prepaid wallet licence.

Prior to the issue of the licence, however, all prepaid instruments must first receive permission from the Reserve Bank of India.

Any Other Person or Organization

To obtain approval from the Apex Bank, all entities except NBFCs (Non Banking Financial Companies) and Scheduled Banks must have a minimum net value of Rs 5 crores.

FEMA's Authorized Entities

It should be noted that all organizations that have been granted permission to grant foreign exchange prepaid wallets under the Foreign Exchange and Management Act 1999 are exempt from the Minimum Capital requirements. However, these payment instruments are only allowed to be used for a restricted number of current accounts

Payment Wallet Licenses of Various Types

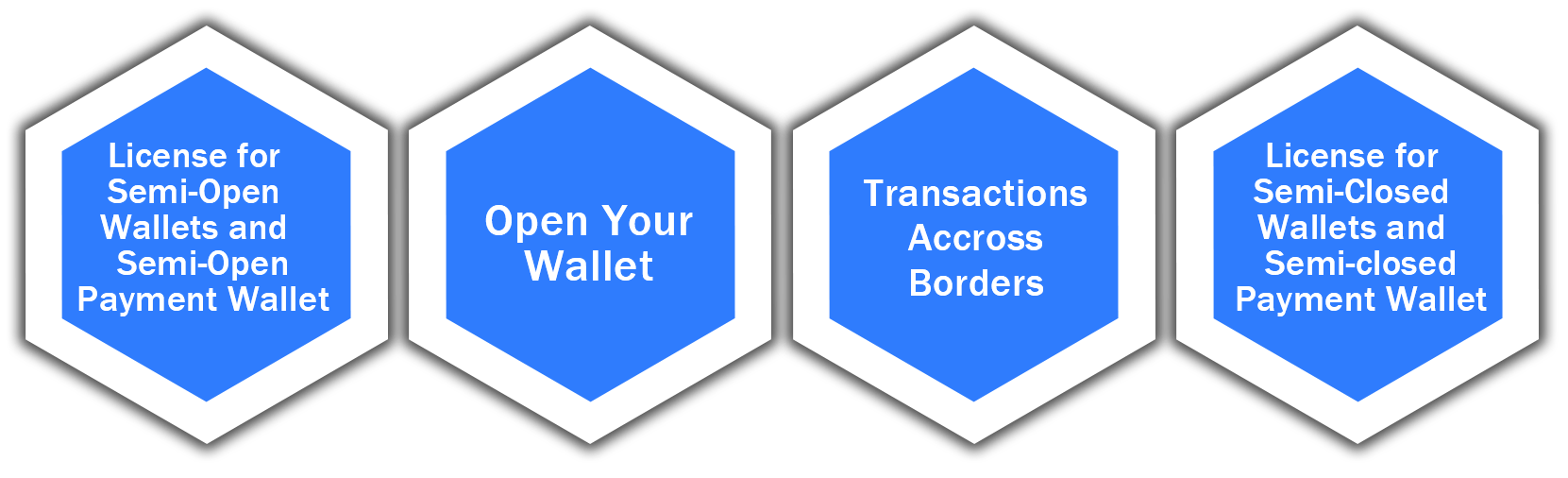

The following are the many types of Payment Wallet Licenses:

Instrument: Closed Wallet or Closed Payment Wallet

Closed Wallet or Closed Payment Wallet Instruments are those that a company issues to its customers just for the purpose of purchasing items from that company. Further, this form of Prepaid Payment Instrument is used for the purchase of products and services of only that company who has provided it.

Reliance Supermarkets, for example.

License for a Semi-Closed Wallet or Semi-Closed Payment Wallet

This is a type of prepaid payment instrument in which the holder is only allowed to buy goods and services from a select group of merchants who have banded together for this purpose. Furthermore, holders of such instruments are not provided with the option of cash redemption or withdrawal.

Mobikwik and Paytm, for example.

License for Semi-Open Wallets or Semi-Open Payment Wallets

Holders of this form of payment instrument can use it to purchase products and services at merchant locations that accept digital cards.

It should be emphasized, however, that the holder of these instruments is not permitted to withdraw cash or redeem them.

Open your wallet

The term "Open Wallet" refers to prepaid payment devices that can be used anywhere to buy goods and services. The owners of these wallets also have the ability to withdraw money from Automated Teller Machines (ATMs).

Transactions Across Borders

Individuals who have been authorized to issue Foreign Exchange denominated Prepaid Wallet Instruments under the terms of the Foreign Exchange and Management Act 1999 are not subject to the Reserve Bank of India's Prepaid Payment Instruments guidelines and directives. It should also be mentioned that the transaction limit for cross-border transactions is Rs 5000.

Preconditions for Obtaining a Prepaid Wallet License

The following are the essential requirements for acquiring a Prepaid Wallet License:

Schedule Banks and NBFCs

Any bank or non-banking financial company that requires prior clearance from the Reserve Bank of India (RBI) in order to obtain a Payment Wallet License.

New Business Entities

A duly certified certificate from a practicing Chartered Accountant is required for all newly incorporated companies that do not have an audited financial statement (CA). Furthermore, these newly formed businesses must reveal their existing net worth as well as a provisional financial statement.

Foreign Direct Investment (FDI)

These businesses must have a certain amount of capital in order to comply with the Foreign Direct Investment Policy's standards.

Other Organizations

According to their most recent audited balance sheet, all other entities must have a minimum net worth of Rs 25 crores.

Companies Act of 2013 Incorporation

A corporation must register as a private or public limited company under the Companies Act 2013 in order to get a prepaid wallet licence. It's also worth noting that a firm can only offer a prepaid wallet if the object clause of its Memorandum of Association allows it.

Obtaining a Payment Wallet License: Basic Requirements

The following are the essential conditions for acquiring a Payment Wallet License:

A) The Company's Net Worth Will Consist of The Following Items:

- Equity Capital that has been paid up.

- Reserves are available for free.

- Preference Shares are a type of preference pool.

- Surplus is represented by Capital Reserves.

- Premium Account can be shared.

B) All banks and non-bank financial companies (NBFCs) must get prior approval and sanction from the RBI's supervisory department.

C) Any existing business entity that has been granted permission to issue prepaid instruments and has obtained a licence from the Apex Bank must increase its net worth in order to meet the previous capital requirements. On or before September 30, 2020, the same will be done in accordance with the guidelines.

D) Prior to obtaining a licence from the RBI, companies must be registered under the provisions of the Companies Act 2013.

E) The MOA's (Memorandum of Association) Object Clause Must Permit the Company to Carry on the Business of a Payment Wallet Instruments Issuer.

Required Documents for Obtaining a Prepaid Wallet License

The following are the documents needed to receive a Prepaid Wallet License:

- Name of the applicant.

- Proof of the Registered Office's Address

- Certificate of Incorporation (Certificate of Incorporation) (COI).

- The Company's Objectives

- Management-related information.

- Information on the Statutory Auditors.

- Balance Sheet that has been audited.

- Names of the stated Company's bankers.

- The Bankers' Address to the Said Company

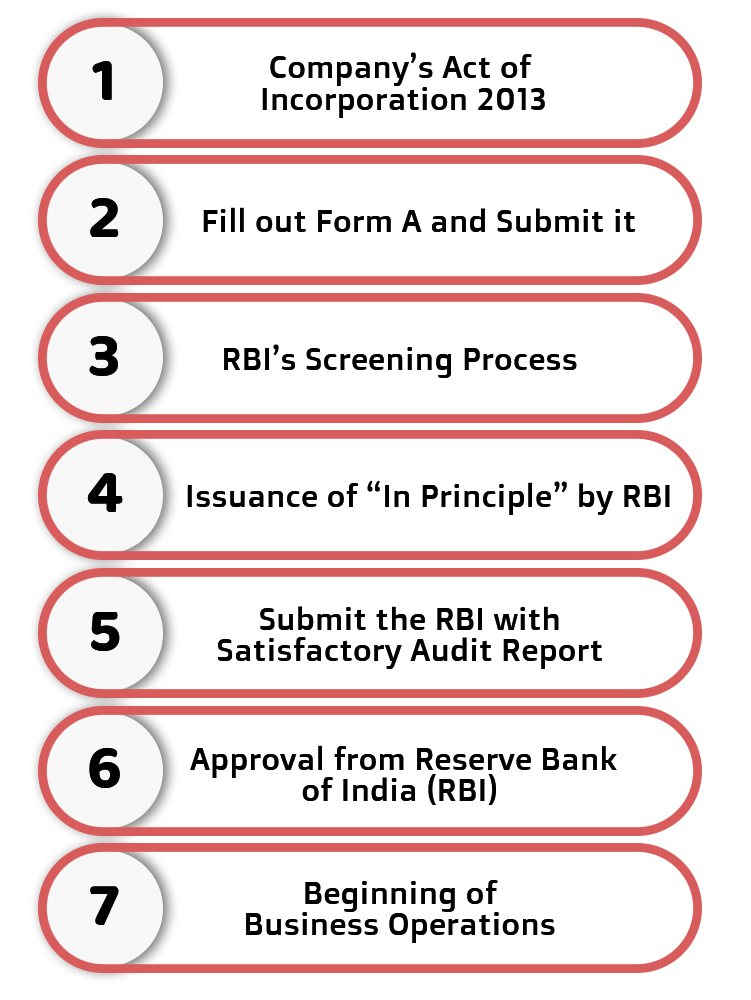

Procedure for obtaining a prepaid wallet licence in India

The following are the stages involved in obtaining a Prepaid Wallet License in India:

Companies Act of 2013 Incorporation

The prospective business must first get a certificate of incorporation in accordance with the Companies Act of 2013.

The applicant company must next submit an application in Form A as the following stage. The purpose is to get approval or sanction in accordance with Regulation 3 (2) of the Payment and Settlement Systems Regulations 2008.

It should also be noted that, in addition to the application, the applicant company must also submit the fees, as well as the following information to the Reserve Bank of India:

- Name of the applicant.

- Proof of the Registered Office's Address

- Certificate of Incorporation (Certificate of Incorporation) (COI).

- The Company's Objectives

- Management-related information.

- Information on the Statutory Auditors.

- Balance Sheet that has been audited.

- Names of the stated Company's bankers.

- The Bankers' Address to the Said Company

- A detailed report on the entity's primary business.

- The Indian Financial System's Expected Profits

- The Proposed Capital Amount in Detail

- Obtaining Funds from Various Sources

RBI's Screening Process

In the third step, the applicant company must successfully complete the RBI's screening process. The rationale for this is to ensure that the candidates are eligible.

Issuance Of “In Principle” By RBI

When the RBI is satisfied that the applicant meets the eligibility requirements, it grants it an "In Principle" approval.

Furthermore, the aforementioned "In Principle" is effective for a period of six months, beginning on the date of the Reserve Bank of India's approval.

Submit the RBI with a satisfactory audit report.

After receiving permission, the applicant company must now submit a Satisfactory Audit Report to the Apex Bank within six months after receiving the approval. It should be noted that if the aforementioned applicant company fails or defaults in completing the Audit Report on time, the granted approval will automatically lapse.

However, by submitting a written appeal to the RBI with sufficient and valid reasons, the company may be granted a six-month extension to deliver the requested audit report.

Approval from Reserve Bank of India (RBI)

The Reserve Bank of India will give final clearance to the applicant company after considering all of the particulars, papers, annexures, and application filed by the applicant company, if satisfied. That is, the apex bank will issue the applicant corporation with a Certificate of Authorization (COA).

Beginning of Business Operations

The applicant company must begin its business operations and affairs within six months of the date of issuing of the Certificate of Authorisation in the final and final step of the process to get a Prepaid Wallet License.

Prepaid Wallet License Validity

Starting from the date of issuance or activation of the authorization provided, the Prepaid Wallet License or Payment Wallet License in India is valid for a minimum of six months.

Furthermore, it should be mentioned that in the event of the Non-reloadable Payment Wallet License, the outstanding amount transferred to a new payment issuer at the time of the payment instrument's expiration is permissible;

Even after the instrument has expired, the outstanding balance in the Prepaid Wallet will not be cancelled immediately.

Business Entities Will Require Additional Approvals

If a non-banking financial company has been granted a COA for the purpose of issuing PPIs (Prepaid Payment Instruments), it must obtain the Apex Bank's prior written approval in the following circumstances:

If there has been any acquisition of control and shareholding of the entity, whether or not the same has resulted in a change of management; if there is a need to change the management of the entity, the result of the same will not be more than a 30% change in the directors of the entity, exclusive of the Independent Director. It should be emphasised, however, that those directors who have been re-elected on the basis of retirement by rotation do not require previous RBI approval.

Why Choose Us

Free Legal Advice

Transparent Pricing

On Time Delivery

Expert Team

Money Back Guarantee

200+ CA/CS Assisted

Lowest Fees

Easy EMIs

Frequently Asked Questions

Prepaid payment instruments are means for purchasing products and services with the value stored on the instrument. The value held on such instruments corresponds to the amount paid for the instrument by the bearer in cash, debit to a bank account, or credit card.

A closed wallet is a mobile wallet or an e-Wallet that is designed to be used to pay in full or in part for services offered directly by the wallet provider. A closed wallet cannot be used to send money or make payments to third-party service providers.

9559179325

9559179325 9559179325

9559179325 9559179325

9559179325