Overview of Peer to Peer Lending License

P2P (Peer to Peer) is a phrase that refers to an online platform or portal that acts as a middleman between lenders and borrowers. A Peer to Peer Lending License from the Reserve Bank of India is required to launch a P2P Lending Business in India. Furthermore, a Peer to Peer (P2P) borrower can be a legal corporate company or an individual.

Nowadays, entrepreneurs and start-ups prefer Peer to Peer Lending for their initial growth because it allows them to grow their businesses without having to borrow money from anyone. As a result, it has become one of the most convenient and popular options for anyone seeking venture capital.

Concept of Peer to Peer Lending License

Peer to Peer Lending is a method of lending money to individuals or businesses via the use of online services that connect lenders and borrowers. In addition, the majority of P2P lending takes place online.

Furthermore, Peer to Peer Lending is a type of debt financing that allows individuals to lend and borrow money without the need for a financial institution to act as a middleman. That is, Peer to Peer Lending eliminates the intermediary from the lending process, saving both the borrower and the lender money on the fees charged by the intermediary. The Reserve Bank of India is the sole body that can provide a Peer to Peer Lending License.

Advantages of a Peer-to-Peer Lending License

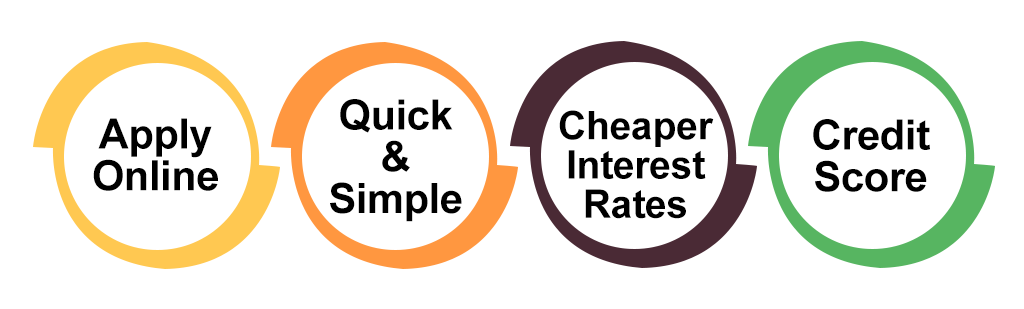

The following are the advantages of a Peer to Peer Lending License:

- The Procedure for Obtaining a Peer to Peer Lending License can be applied for online.

- P2P lending is a quick and simple way to lend and borrow money.

- People can now get loans with cheaper interest rates.

- Obtaining an Initial Quote has no bearing on one's credit score.

- Acts as an alternative to regular lenders when it comes to offering loans.

- Traditional loans are less flexible than loans provided by Peer to Peer Lending Platforms.

- P2P Digital Platforms connects borrowers with lenders that can help them.

Peer to Peer Lending License Basic Characteristics

The following are the basic characteristics of P2P Digital Lending Platforms:

- Peer to Peer Lending Platforms are internet marketplaces that connect borrowers with lenders who can help them.

- There is no requirement for the lender and borrower to have previously worked together.

- A financial institution acting as an intermediary between the lender and the borrower is not involved or engaged in Peer to Peer Lending Platforms.

- It should be highlighted that both lenders and borrowers are free and capable of making their own decisions on borrowing and investment.

Peer to Peer Digital Lending Platform Management

A Peer to Peer Digital Lending Platform's operation can be summarized as follows:

- The party in question, whether it is the borrower or the lender, must register on the online Peer to Peer lending platform. The same can be accomplished by providing the P2P Lending Company with the requested information.

- After registration, the appropriate Peer to Peer Lending Platform will complete the Due Diligence procedure.

- During that, parties who received a positive report following the Due Diligence procedure will need to obtain approval before creating their main profile on the portal. They will be able to contact other parties and communicate with them in order to reach an agreement on a loan.

- Now, the loans made by the Peer to Peer Lending Business can be both secured and unsecured, and they are typically of a form that is not covered by government insurance.

- It should also be mentioned that Peer to Peer Lending platforms can readily provide loan transfer services, such as securities for the purpose of profit or debt collection.

Eligibility Criteria to Start Peer to Peer Lending Platform in India

The following are the eligibility criteria for obtaining a Peer to Peer Lending License in India:

- In order to receive a Peer to Peer Lending License in India, a company must first obtain a Certificate of Registration under the Companies Act 2013.

- A company that wants to get a P2P Lending License in India must have at least Rs 2 crores in NOF (Net Owned Funds).

- If a Company or a corporate entity was already conducting such a business before the Reserve Bank of India made obtaining a Certificate of Registration required, then such a Company will meet all of the Reserve Bank of India's requirements.

Conditions to Start Peer to Peer Digital Lending Platform in India

The following are the basic requirements for launching a Peer to Peer Lending Digital Platform in India:

- The company must be registered and incorporated in India.

- All of the necessary entrepreneurial, managerial, and technological resources must be available to the organisation. The same is required to provide participants with Peer to Peer digital lending services.

- To manage a Peer to Peer Digital Lending Platform, the organisation must have the appropriate financing structure.

- All prospective Directors and Promoters must be proper and fit; the company's management's overall character must not be adverse to the general public's interest.

- If the claimed company has not previously done so, it must present a strategy for implementing a secure and safe Information Technology Mechanism.

- In order to run a Peer to Peer Digital Lending Portal, the applicant company must submit a viable business strategy.

- In the event that the Company is granted a Certificate of Registration (COR), the public interest will be served.

- Any additional criterion, as determined by the Reserve Bank of India, that ensures that founding or operating such a business in India would not be damaging to the general public's interests.

For Companies

- If a new private limited company applies for a COR and meets all of the above-mentioned criteria, the RBI will grant it in principle approval to create a Peer to Peer Digital Lending platform, subject to the fulfilment of any other requirements the RBI deems appropriate.

- The in principle approval is valid for a period of twelve months from the date of grant.

- The claimed applicant company will be required to create its technology mechanism within a twelve-month period. The same procedure is followed to complete all necessary legal papers and to submit to the RBI all compliances that are required.

- If the Apex Bank is satisfied that the applicant company is ready to begin its Peer to Peer Lending activities and affairs, it will provide the Certificate of Registration (COR), subject to the fulfilment of such conditions as it may judge appropriate.

Permitted Activities of Peer to Peer Digital Lending Platform in India

The following activities are permitted by Peer to Peer Digital Lending Platforms in India:

- To provide an online platform to all players in the peer-to-peer lending process, acting as their mediator.

- Under neither the Companies Act 2013 nor the RBI Act's section 45 I (bb), a Peer to Peer Lending Business is permitted to raise deposits.

- They are not permitted to lend money to one another.

- They are not permitted to provide or arrange any type of credit enhancement or guarantee.

- A Peer to Peer Lending Digital Platform is not permitted to support or allow any secured or safe lending on their online platform. Furthermore, lending permission is only granted for clean loans.

- They are not permitted to include any monies obtained from lenders (for the purpose of lending) or borrowers (for the purpose of servicing loans) in their annual balance sheet.

- Except for the loan-provided insurance products, P2P Digital Lending Companies are not allowed to market any other products or services.

- An international movement of funds is not permitted on a P2P Digital Lending Platform.

- A P2P Lending Company is expected to comply with all legal requirements that apply to the engaged participants under the applicable legislation.

- It is mandatory for all Peer to Peer Lending Companies to store and process all data related to their activities and participants on hardware located in India.

In India, what are the responsibilities of a peer-to-peer digital lending platform?

The following are the responsibilities of Peer to Peer Digital Lending Platforms in India:

- Before approving suggested participants as P2P platform players, the company does due diligence on them.

- Performing risk profiling and credit assessments on listed borrowers and disclosing the results to registered lenders.

- Participants' express and previous consent is required to get access to their credit information.

- Performing the documentation procedure for loan agreements and other relevant documents.

- Providing assistance with loan repayments and payout.

- Providing loan recovery services for the loans that are originated on the platform.

Fund transfer mechanism for a Peer-To-Peer digital lending platform in India

In India, the funds transmission procedure for acquiring a peer-to-peer lending licence is as follows:

Funds are exchanged between participants on Peer to Peer Digital Lending platforms using an Escrow Account Mechanism, which will be controlled and carried out by a Trustee.

For the funds transfer mechanism, a minimum of two Escrow accounts must be maintained. The first is for receiving funds from lenders that are awaiting disbursement, while the second is for borrowers.

Only bank accounts will be used to conduct all transactions and dealings. This means that cash transactions are strictly prohibited.

Process for obtaining a Peer to Peer Lending License

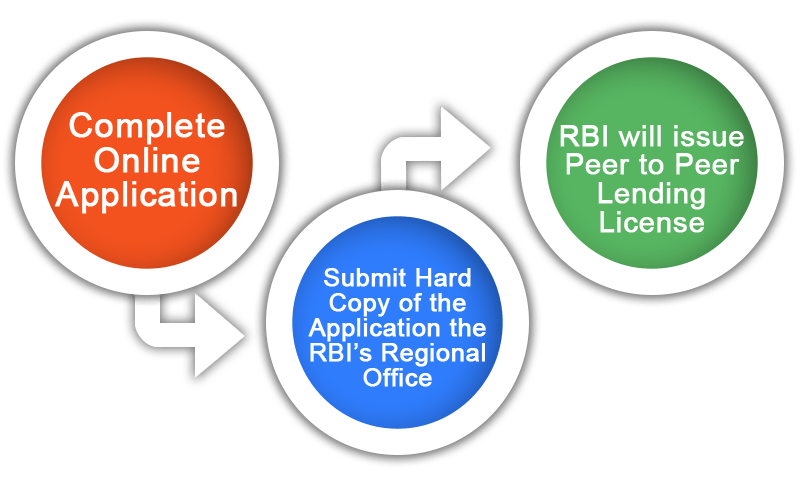

The procedures in obtaining a Peer to Peer Lending License in India can be stated as follows:

- The applicant company must be registered in India as either a Private Limited Company or a Public Limited Company, with the primary goal of raising funds.

- A minimum NOF (Net Owned Funds) of Rs 2 crores is necessary to obtain a Peer to Peer Lending License.

- Submit the work flow for the main website and mobile application in the next step.

- Following that, the applicant company must submit an online application, which may be found on the RBI's COSMOS website.

- The applicant company must now submit a hard copy of the application, along with the supporting documentation, to the Reserve Bank of India's regional office.

- Finally, the apex bank would issue the Peer to Peer Lending License only after a thorough examination of the filed application and any supporting papers.

Crowdfunding vs. Peer to Peer Lending: What's the Difference?

Peer to Peer digital lending is a sort of crowd-funding in India, in which loans are raised and repaid with a fixed interest rate. Furthermore, the Peer to Peer Lending Platform is an online platform where lenders and borrowers can register to raise unsecured loans. Furthermore, the borrower will be either an individual or a legal corporate entity under this arrangement.

Transparency and Disclosure for Peer to Peer Lending Business Requirements

The following information must be disclosed to the lender by a Peer to Peer Lending Company:

- The information about the borrower's personal identity, the interest rate sought, the loan amount needed, and the credit score.

- The information on the loan's terms and circumstances, such as the return, taxes, and fees.

To the borrower, the following disclosures must be made:

- The amount proposed by the lender and the rate of interest offered are described in full.

The lender's personal identification and contact information are not need to be disclosed to the borrower. The following information will be made public on the Company's website:

- Methodology for Resolving Complaints.

- A well-thought-out business Plan.

- Portfolio performance on a monthly basis, including non-performing asset information.

- User data usage and protection disclosures.

- An overview of credit scoring and the things that go into it.

Why Choose Us

Free Legal Advice

Transparent Pricing

On Time Delivery

Expert Team

Money Back Guarantee

200+ CA/CS Assisted

Lowest Fees

Easy EMIs

Frequently Asked Questions

A peer-to-peer lending platform is a sort of lending platform that connects borrowers and lenders. Peer to peer financing has become a popular and convenient option for most start-ups and entrepreneurs seeking venture capital in the early stages of their businesses. At this point, businesspeople may easily receive funds from the general public.

P2P lending's safety is determined by factors such as lending money to low-risk borrowers following thorough verification.

9559179325

9559179325 9559179325

9559179325 9559179325

9559179325